Cryptocurrency

Oh god I invested in Crypto in summer 2020 before it blew up. I didn’t hold for long enough…

Update May 2022: Look at what is happening at the LUNA Coin, it claimed to be a stablecoin with 20% yearly yield. And in the past week, it went from 100. Like they literally deactivated the platform. Talk about being decentralized or stable…

Key takeaways: If it is too good to be true, it probably is.

I had lots of doubts about crypto because there are a lot of bad actors in this space who want to make lots of money short-term. And I didn’t fully understand it, and as George Hotz put it, it could have been good if not all the greedy people sucked the blood out of it.

List of blood-sucking companies:

- Luna

- FTX

- Binance

But is there still hope in crypto? After seeing the rise again in 2024, and seeing just how long crypto has been around without dying (Bitcoin, ETH, Cardano) for the past decade, I think it’s extremely reasonable to say that it’s probably the best investment you can make.

And there are more and more people believing in it. Just like Fiat Money.

- But it just takes the snap of a finger to break the trust.

So I’m just going to make sure I understand before making huge investments again.

Thoughts

More complex ideas that haven’t been explored:

- Creating debt / loans

Okay, going to spend some time to reflect here on how money works, and how cryptocurrency fits into this, and whether it actually its going to be worth anything in the next decade.

So the way value is created in this world is supply and demand right.

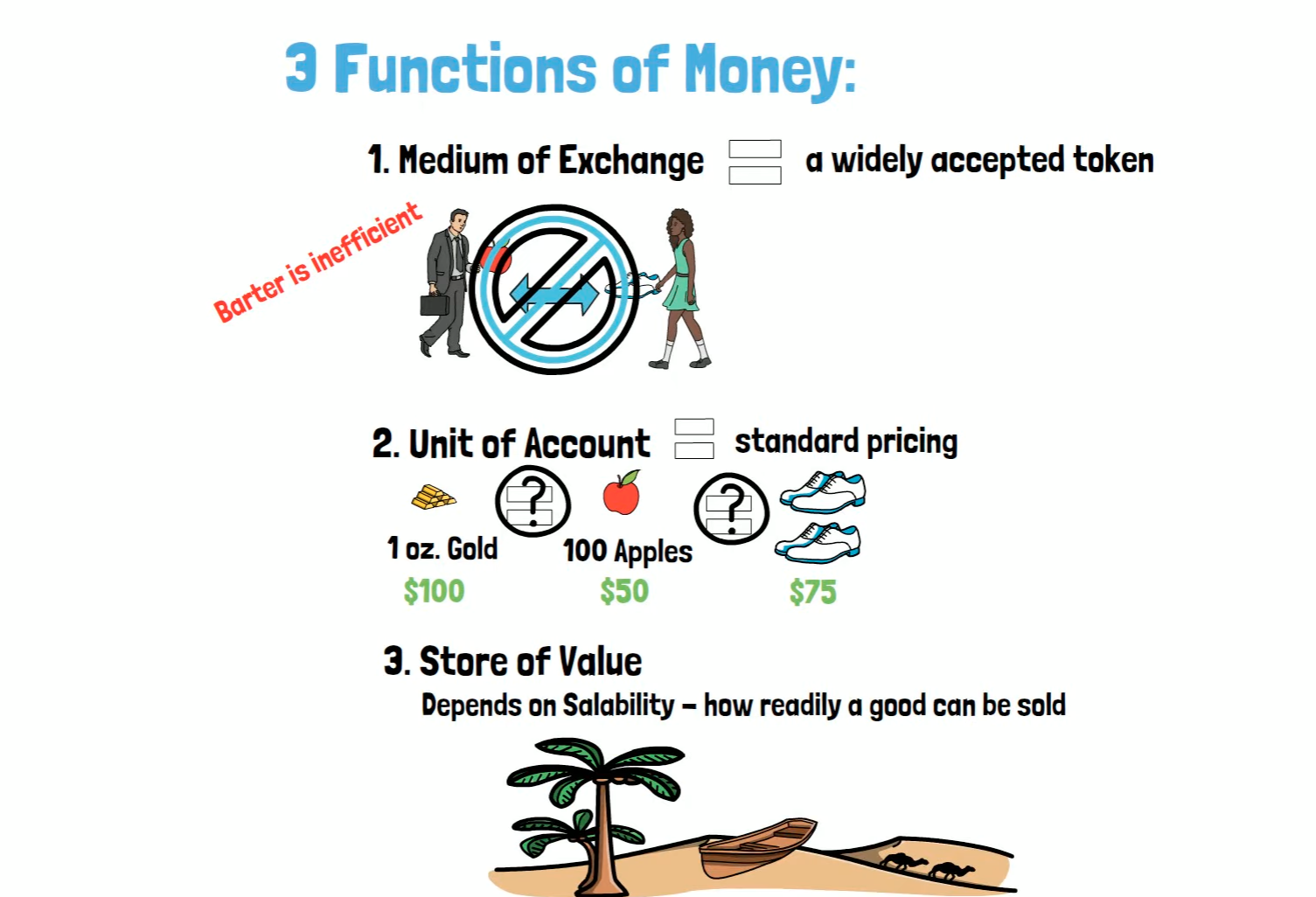

Each of us create things in this world, and there are things that we need. We need to eat food, but there are other things like maybe new shoes and a new car. We can make all of these ourselves, and that’s actually what happened at first, when we lived as individuals. But then we emerged in groups. And we specialized (look up . People started having jobs. We started with Bartering, direct exchanging products with each other.

But bartering is not efficient. Let’s say I am specialized in making shoes. And I want food. I don’t plant my own food. So I go talk to a farmer. However, I only have shoes to give him. That’s kind of bad. He probs doesn’t want shoes at the moment, but he does need other things.

So we want some intermediary currency to exchange on, to acquire various things. This is what “money” is for.

The book The Bitcoin Standard talks about 3 functions of money:

- Medium of exchange

- Unit of account

- Store of value

So there’s a few ideas on what “money” we can use:

- Gold

- Apples

- Shoes

But each of these have some problems right?

- Apples go bad

- They’re not suitable for all kinds of transaction. Like it needs to be divisible into small chunks

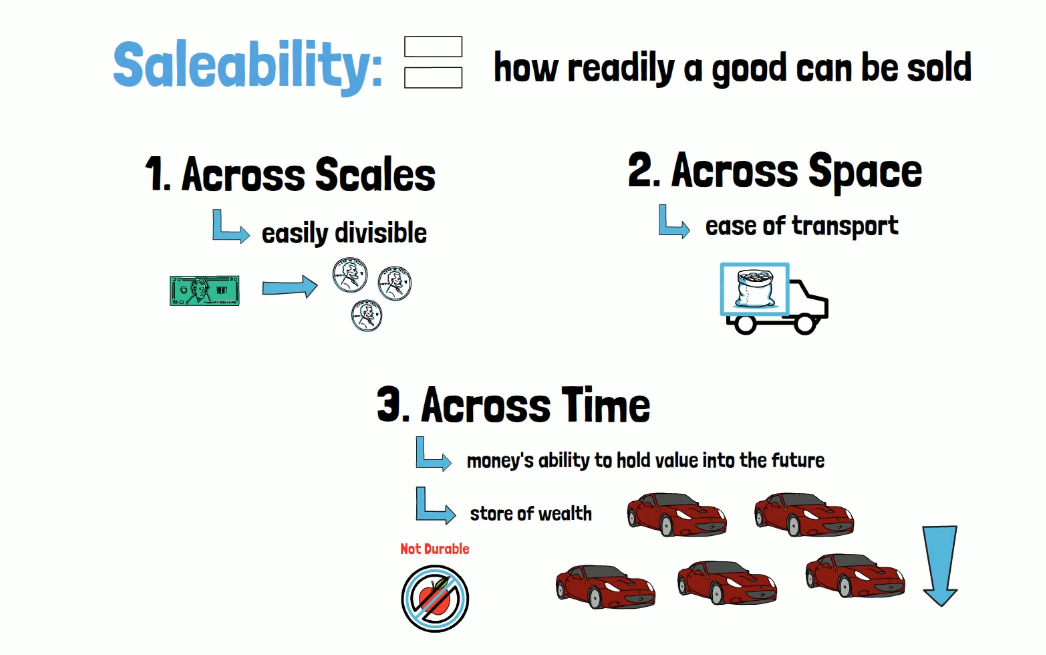

There are these 3 criterias for this currency that we want:

- Easily divisible across scales

- Ease of transport across space

- Store of value across time

So here we need to think a little harder about how money can hold value.

Like if we say each of my shoes is worth 10 dollars, who says that is going to be true in the future? How do you quantify the intrinsic value of “money”?

Well that depends on who produces the money!

Let’s say you use gold as the currency. Well, in theory, you can go get gold yourself and create money. There are shortcomings of this, looking at the criteria above: it’s not super easily to divide (imagine buying an apple with gold, you’d lose the gold thing), nor transport.

So the solution is to create money that is backed that the commodity. That’s known as Commodity Money, and the US actually did this until the 1971s. A 1 dollar note could be exchanged for a specific amount of gold (after WW2 until 1971, the US dollar was pegged to gold at $35/ounce).

So when the value of gold goes up, the value of USD goes up?

Yes, in Commodity Money, the value of the currency is tied to the value of the commodity.

What about the other way around? Can USD drive the price of gold?

No, by definition (under commodity money). However, this is no longer true under Fiat Money.

When the US spent its own US dollars, it doesn’t actually lose gold. It still holds the gold. So how does that work?

- So I guess initially the US had all the USD, backed by its reserves. Its citizens use that USD however they want. Citizens can also get gold, and redeem for USD, which can be printed. If other countries want USD, they send gold to the US, and then the US can print some USD for them.

But the US is the arbiter of the USD money, they have the gold reserve.

Banks under the gold standard could issue more loans than the gold they held in reserve (a practice called fractional reserve banking). This effectively “created” money, though it was constrained by gold reserves.

How does the economy grow in commodity money? Is money printing a thing still?

- Yes, when you mine more gold, you can create more paper bills

Fiat Money

But there are issues with this. The US itself abandoned commodity money in 1971 under President Nixon, in favour of Fiat Money:

- Tying the dollar to gold limited the government’s ability to respond to economic crises, such as recessions or depressions

- For example, if more money was needed to stimulate growth, the government couldn’t just “print” money without depleting gold reserves

Why?

- Constraints on Monetary Policy:

- Under the gold standard, the supply of money was tied to gold reserves. This limited the ability of the government and the Federal Reserve to expand the money supply to address economic downturns.

- During recessions or depressions, governments often need to inject liquidity (print money) to stimulate growth. The gold standard restricted this flexibility.

- Global Pressures:

- By the 1960s, countries holding US dollars began to lose confidence in the dollar’s convertibility to gold. Excessive US spending, particularly on the Vietnam War and domestic programs, caused inflation and eroded trust.

- Other countries started demanding gold for their dollars, threatening US reserves.

- Economic Growth Needs:

- The growing global economy required a more elastic monetary supply than gold-backed currency could provide.

Was that a smart idea?

- Did printing money under fiat money help us grow the economy faster and get out of recessions?

- Increasing the money supply can lower interest rates, making borrowing cheaper for businesses and consumers

- if you print too much money, you get Hyperinflation (like Venezuela)

Okay, so maybe it’s centralized. Nobody can create money apart from the government. So you would think that there is a fixed amount of money?

- Money can be printed every time the supply of commodity grows for that

Why is printing money necessary?

Because the economy grows right?

Imagine a society with 3 people, a shoe maker, an farmer, and a car maker. We come up with an agreement that each shoe is worth 70 dollars, and each apple is worth 2, and a car is 1000.

How does this society get initialized with money? My idea is that there will be some banker with an “infinite” supply of money. Then, you go the banker, and if you give him a shoe, he will give you 70 dollars. And then you can use that shoe.

But that’s actually not how it works right. Because the bank doesn’t want your stuff. And your stuff’s value is not determined by the bank, it’s determined by the wider society.

- Well, that’s how we can start circulating money though. And if that money has intrinsic money (like gold), I don’t see an issue. The more people adopt it, the easier it is. The person who has the gold can print the money (so that’s the bank).

- Under Commodity Money, we can only print US dollars when there new gold discovered that we store into “banks”.

- Look at when the Gold Standard was around.

- Countries would send over gold to US in exchange for US money that they could use to purchase

As an economy grows, the total value of goods and services increases. To facilitate these transactions, the money supply must grow proportionately

But no, what happens as an economy grows? Printing money is necessary as more value is created in the world.

So isn’t cryptocurrency like bitcoin just a better commodity money at the end of the day?

- So yea, bitcoin can never replace fiat money, because they have a fixed supply of 21 million

But gold can be useful to build things, bitcoin cannot...?

Like the next day, I can decide bitcoin is worth 0. But I can’t decide that for gold, because there is demand for it, when I make my semiconductors or jewelry

Bitcoin’s value relies heavily on trust, whereas gold has intrinsic value due to its physical properties and industrial demand.

- In that sense, bitcoin is like Fiat Money, because it is not backed by some physical commodity.

Storing value

The most fundamental problem with money, which is how it stores value, where both commodity and fiat money struggles:

- Commodity money: The commodity can also depreciate over time. For example, while the supply of gold is limited, it can still be mined, and new discoveries of gold can increase the total supply, which could potentially reduce its value over time

- Fiat money: there is inflation, and money depreciates in value. If it depreciates too fast, it becomes hard to use

Why is money being able to store value important?

- imagine your 1USD is worth 0.5 USD the next day, you lose your buying power by holding onto it

Seashells became bad as money because soon people found ways to extract them more easily. There was much more flow than stock, resulting in people with lots of seashells becoming super rich because they could buy everything, but then it magically balances out?

The market balances itself

If bitcoin was free, that’s impossible, many people would buy it. Just like you can’t just get USD for free.

The edge case is like Venezuela, where they printed so much money that it collapsed the economy.

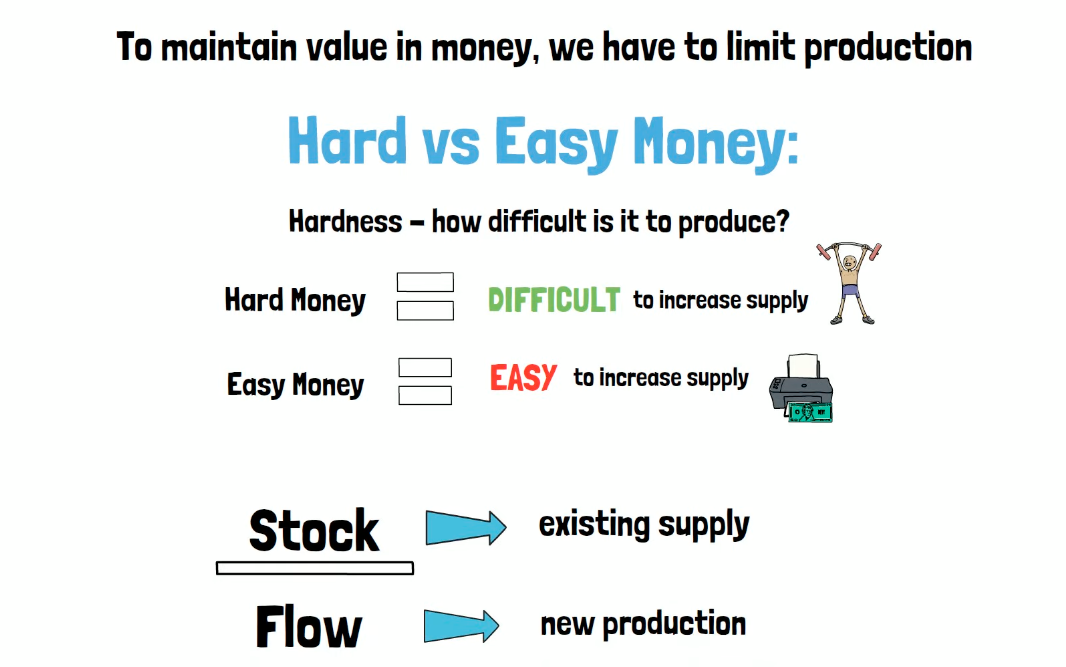

To better understand money, we need to understand that we can categorize money in 2 ways:

- Easy money (easy to increase supply)

- Hard money (difficult to increase supply)

The paper money (US dollar, CAD dollar) that you are familiar with today is called fiat money. It’s not “backed” by anything. Unlike gold, which has intrinsic value due to the fact that it is needed by people.

USD is backed by faith.

I still don’t understand how value is stored?

- Gold has value because it is useful to do things (commodity money)

- USD has value because people believe in it and can exchange it for goods / services (fiat money)

In that sense, bitcoin is a fiat money in terms of how value it stores, without the downsides of inflation, nor the downside of gold because there is a fixed supply.

There are problems with bitcoin in terms of how many transactions it can do, but the fundamentals are there.

Gold vs. Bitcoin

Bitcoin vs Gold: The Great Debate with Michael Saylor and Frank Giustra (at t=844s)

- Why is bitcoin a better asset?

Gold’s usefulness in creating products does contribute to its value, but this role is limited compared to its historical and cultural significance.

Gold before was never used to make computers. It was mainly used as a currency. Always. It had no intrinsic value. Just like a rock.

Banks have no allegiance to bitcoin. They do to gold.

Gold serves dual purposes as being useful, and a store of value.

- It’s usefulness is not what drives its store of value

It’s more supply and demand. Else, why do these banks have so many reserves of gold.

The gold guy makes a good point about the volatility of bitcoin. Gold has actually been tested through times of crisis. It serves as protection to fiat currency.

Volatility of bitcoin

Why is bitcoin so volatile? That makes it bad to hold value no?

- it’s a new market

Bitcoin is still a relatively young asset, having been created in 2009. Its market is still evolving, and it has not yet reached the level of institutional maturity that would provide stability

Why is gold much less volatile? Because it has a market cap of 20T$.

Bitcoin vs. Ethereum

https://www.youtube.com/watch?v=3VgrmNZ40qI by Michael Saylor

bitcoin is a property

- You can’t influence it now, it’s its own thing

other smaller cryptos are security

Conclusion

Based on the thoughts above, it seems reasonable that bitcoin is the best candidate for holding value long term. It is still super volatile because the market isn’t sure about it. Right now, people are super bullish (Nov 2024). But that might change. But there’s no other candidates.

And many companies are buying into it. It’s more and more recognized.

P.S: This is not investing advice.