Rate of Return Analysis (IRR)

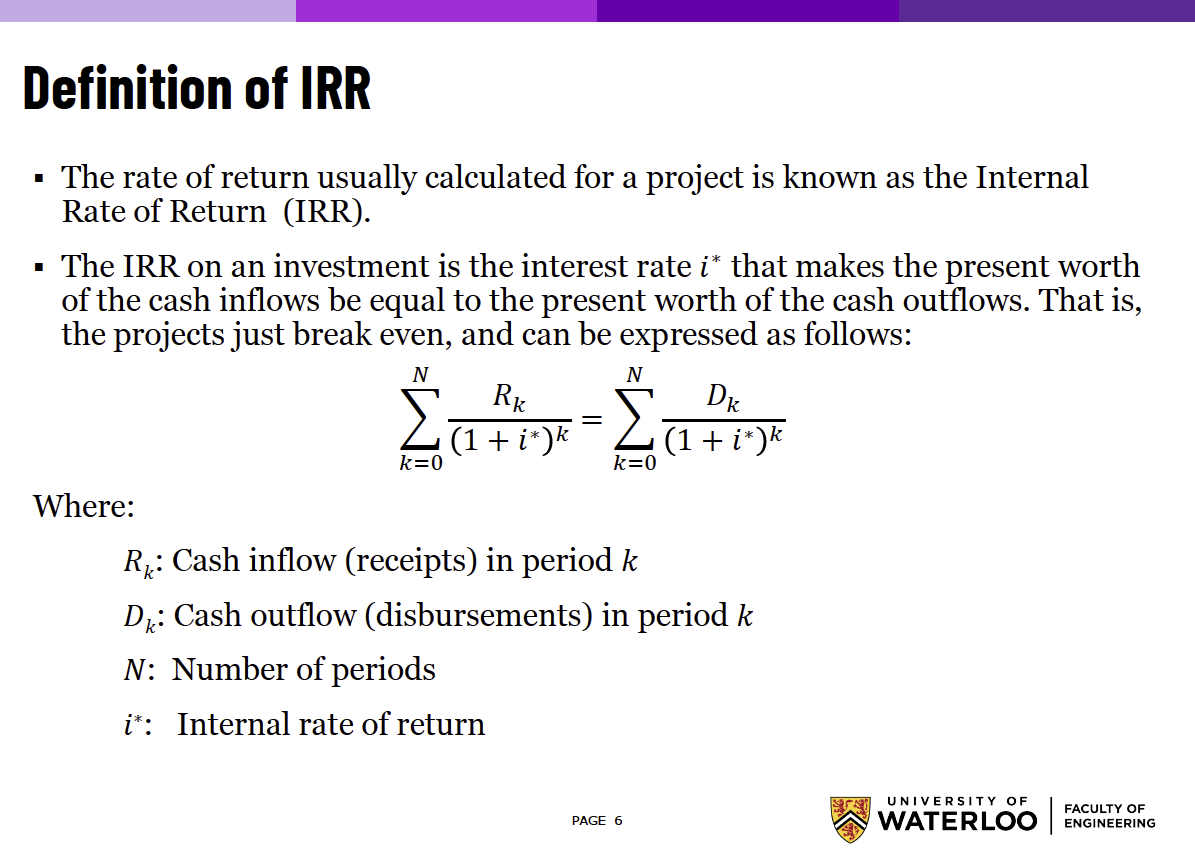

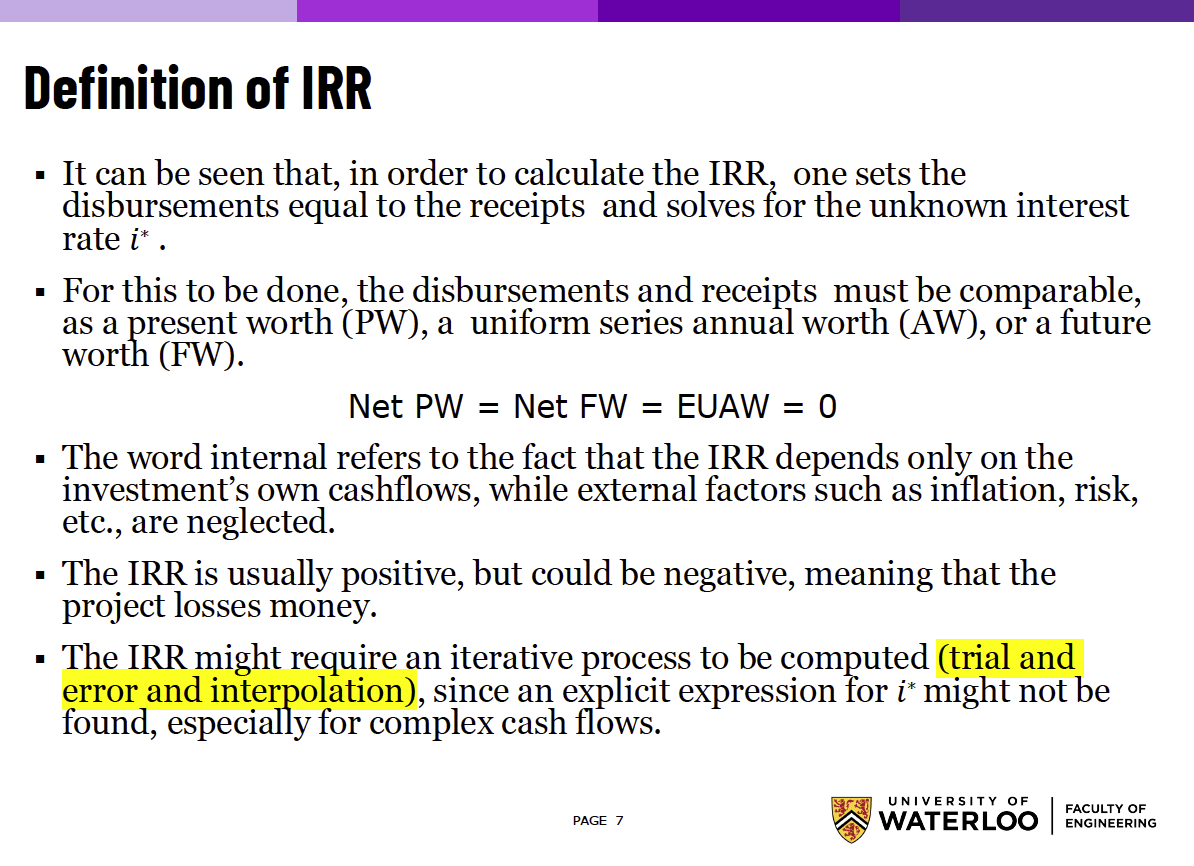

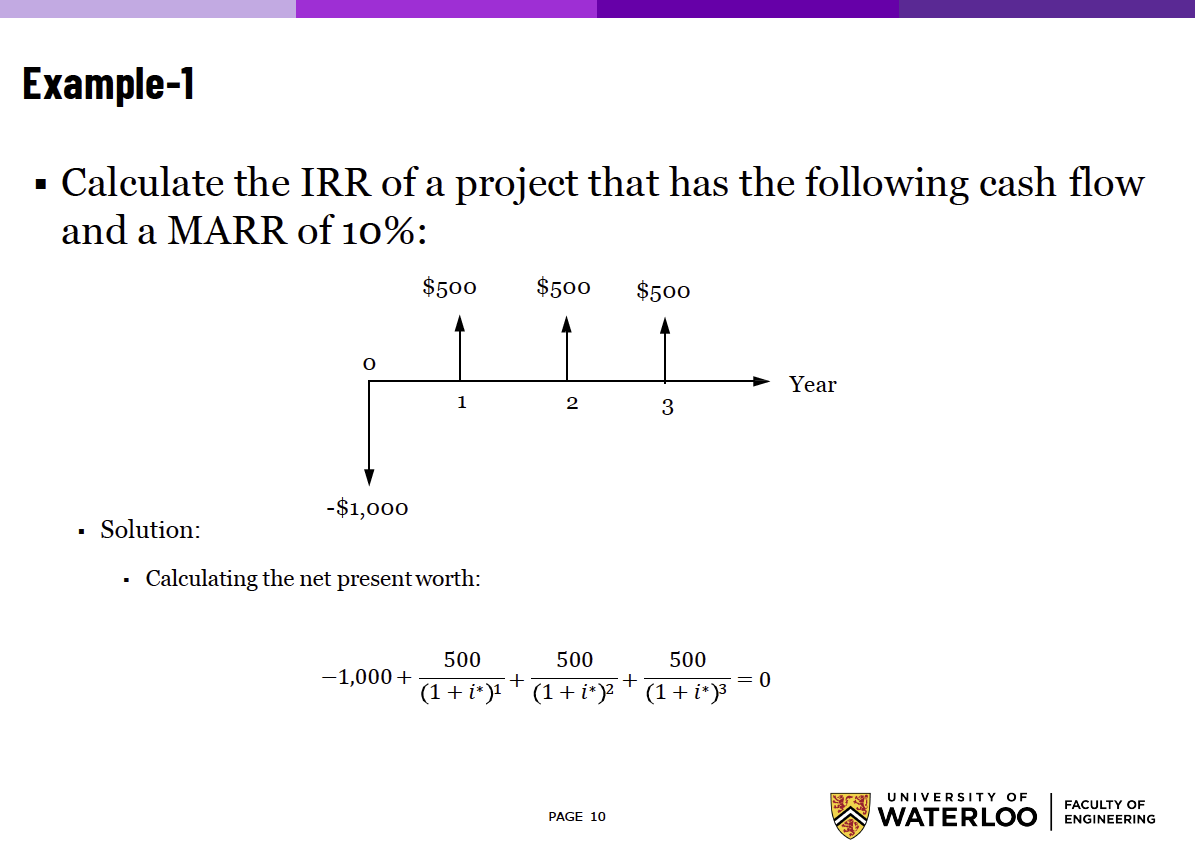

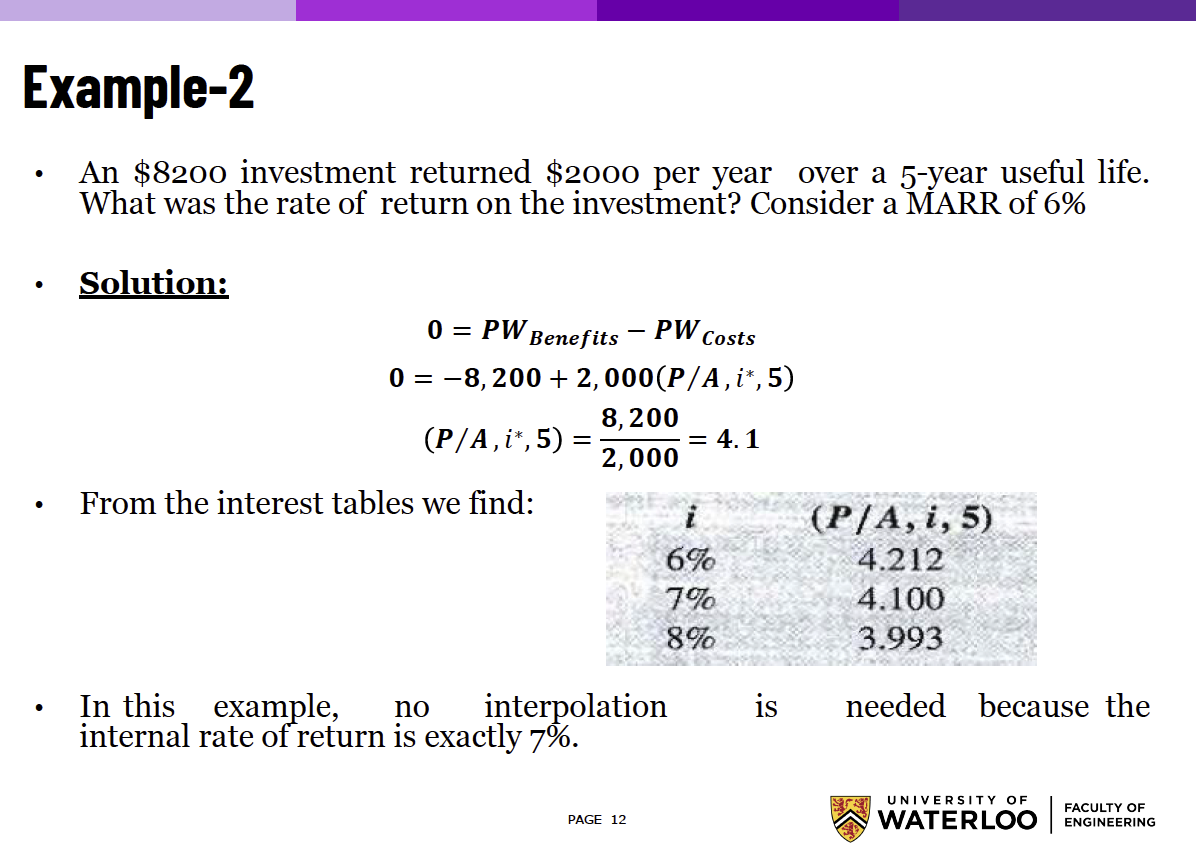

Basically, we are solving for an unknown interest rate .

- The idea when we solve is to set the Net Present Worth to 0, and solve for

Internal Rate of Return Analysis (IRR)

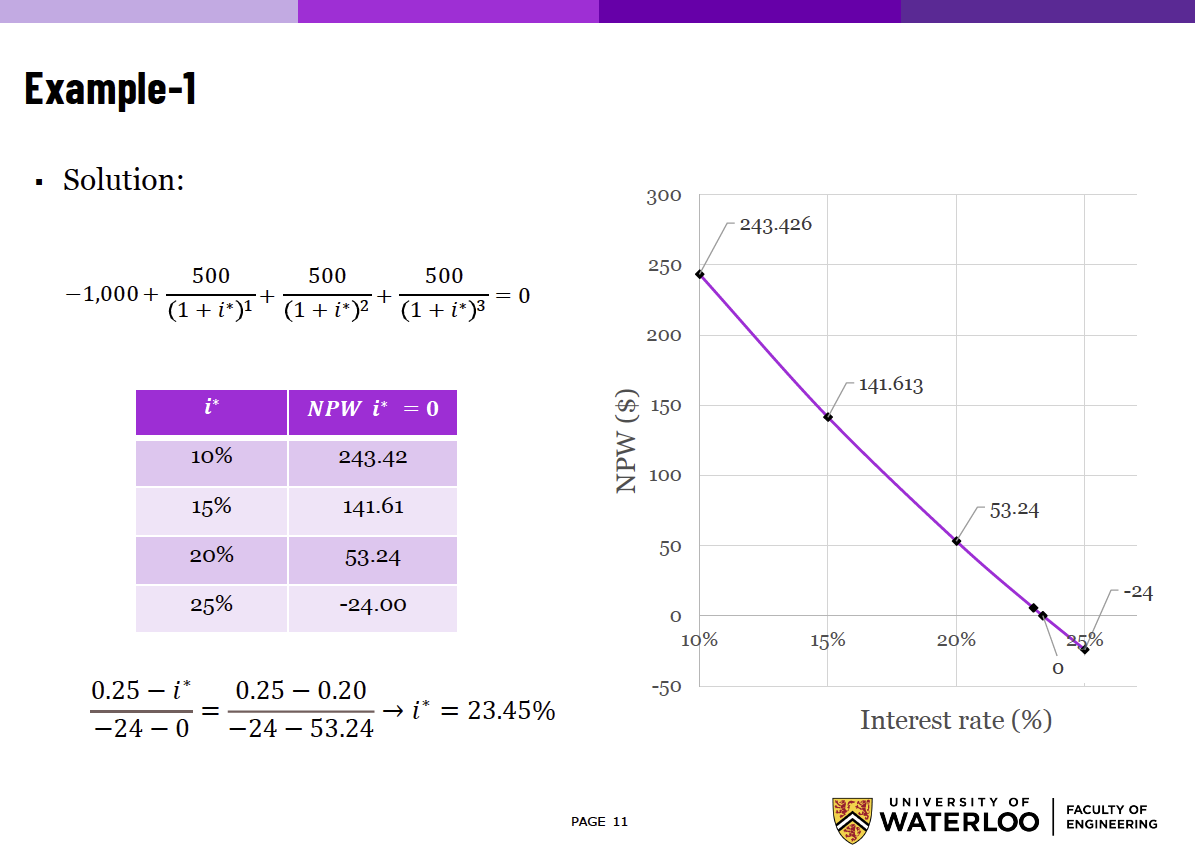

The example below was so confusing to me, but I finally get it. They probably should have shown example 2 first though.

- The idea is that we are trying to solve for . Below, they show a table with different values of , and the values that they return for the RHS.

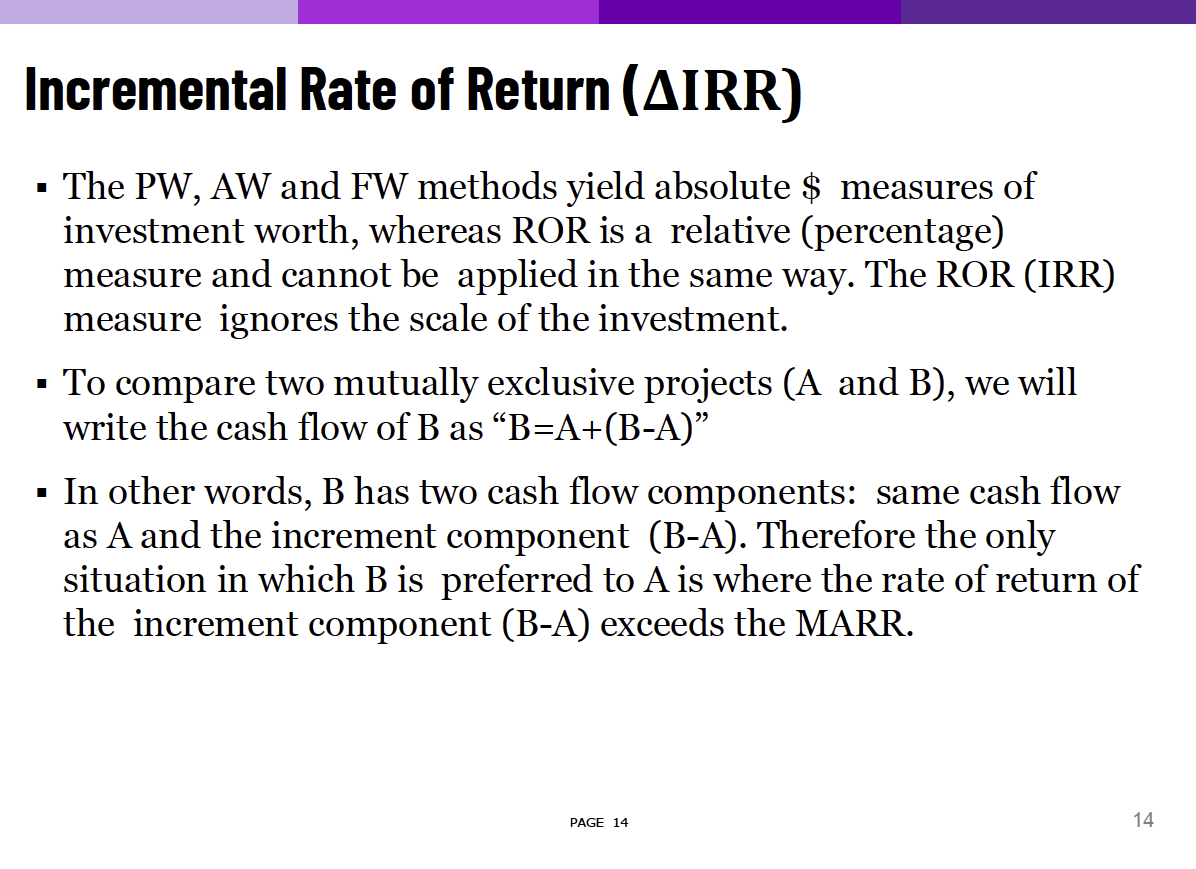

Incremental Rate of Return (ΔIRR)

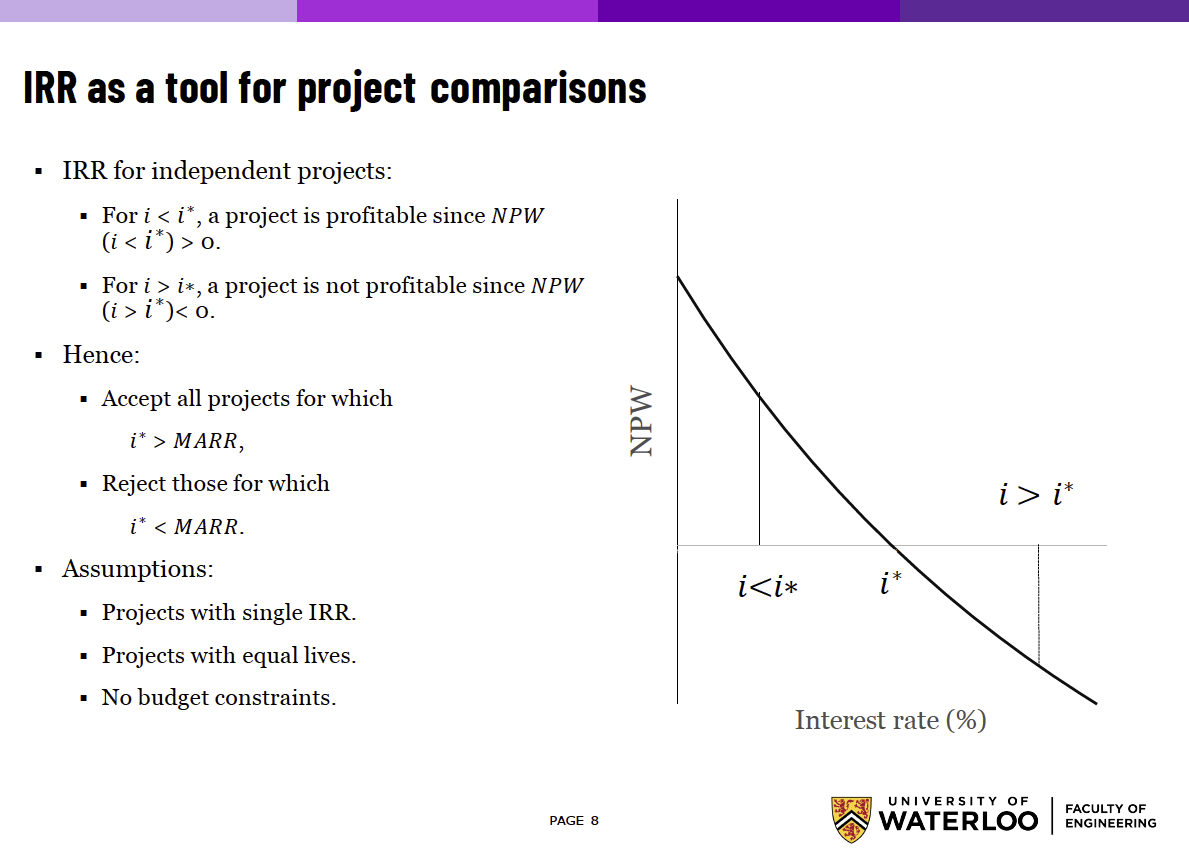

ummm so do we always just use the incremental rate of return, or do we do the other things too?

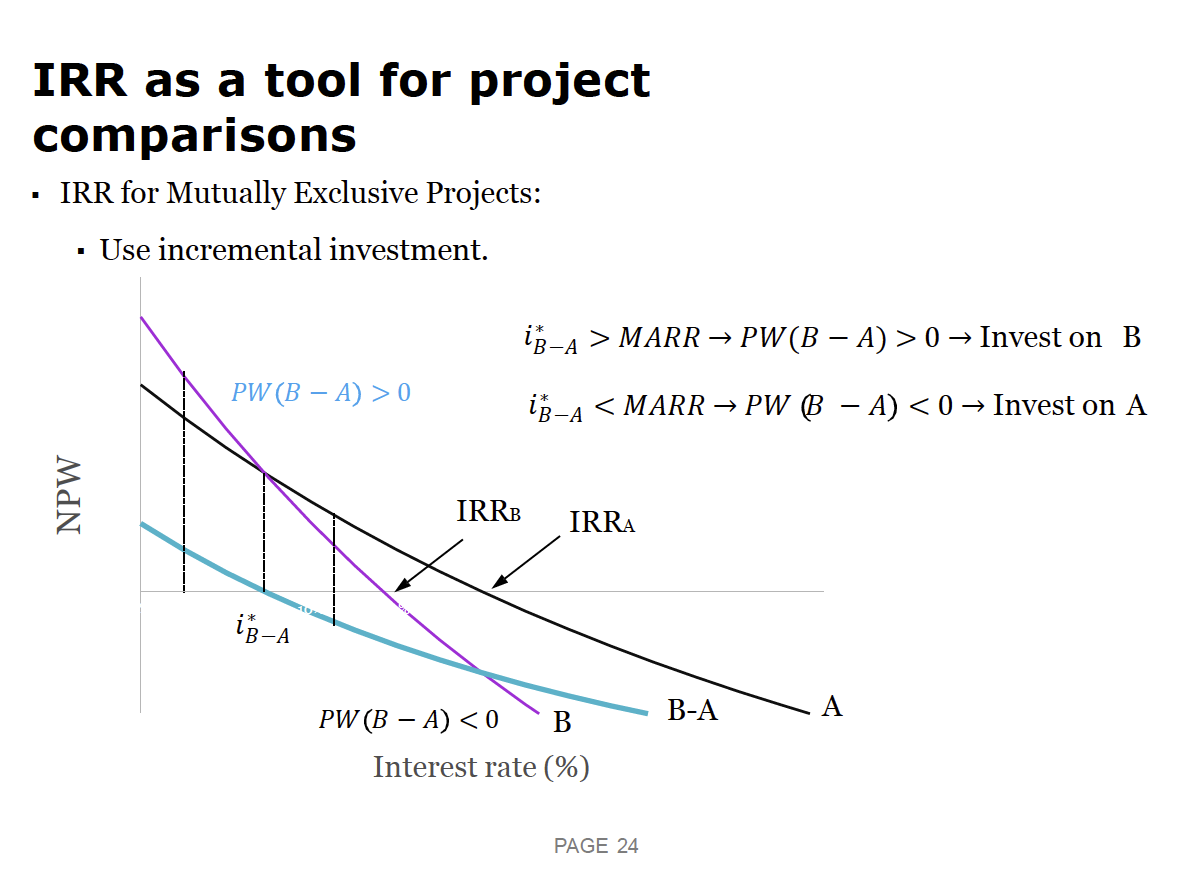

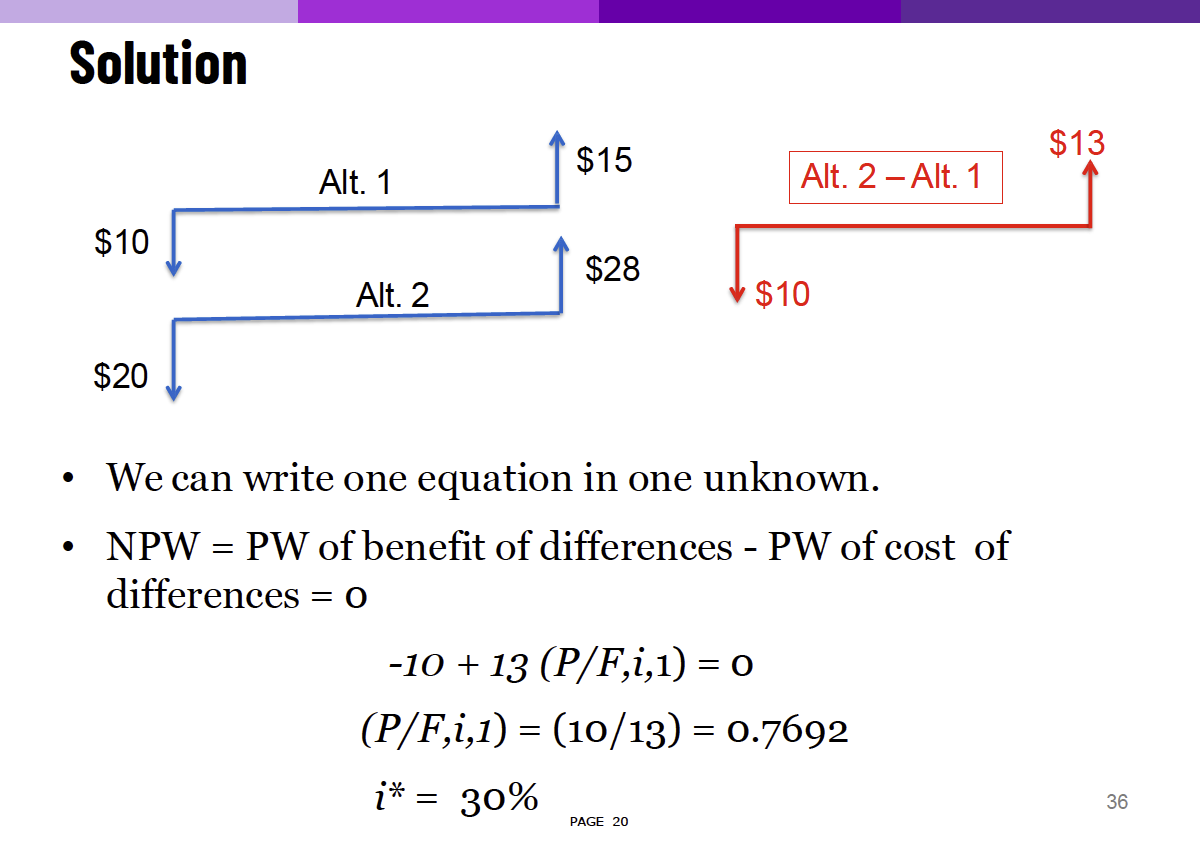

IMPORTANT: To compare two mutually exclusive projects ( and ), we will write the cash flow of as .

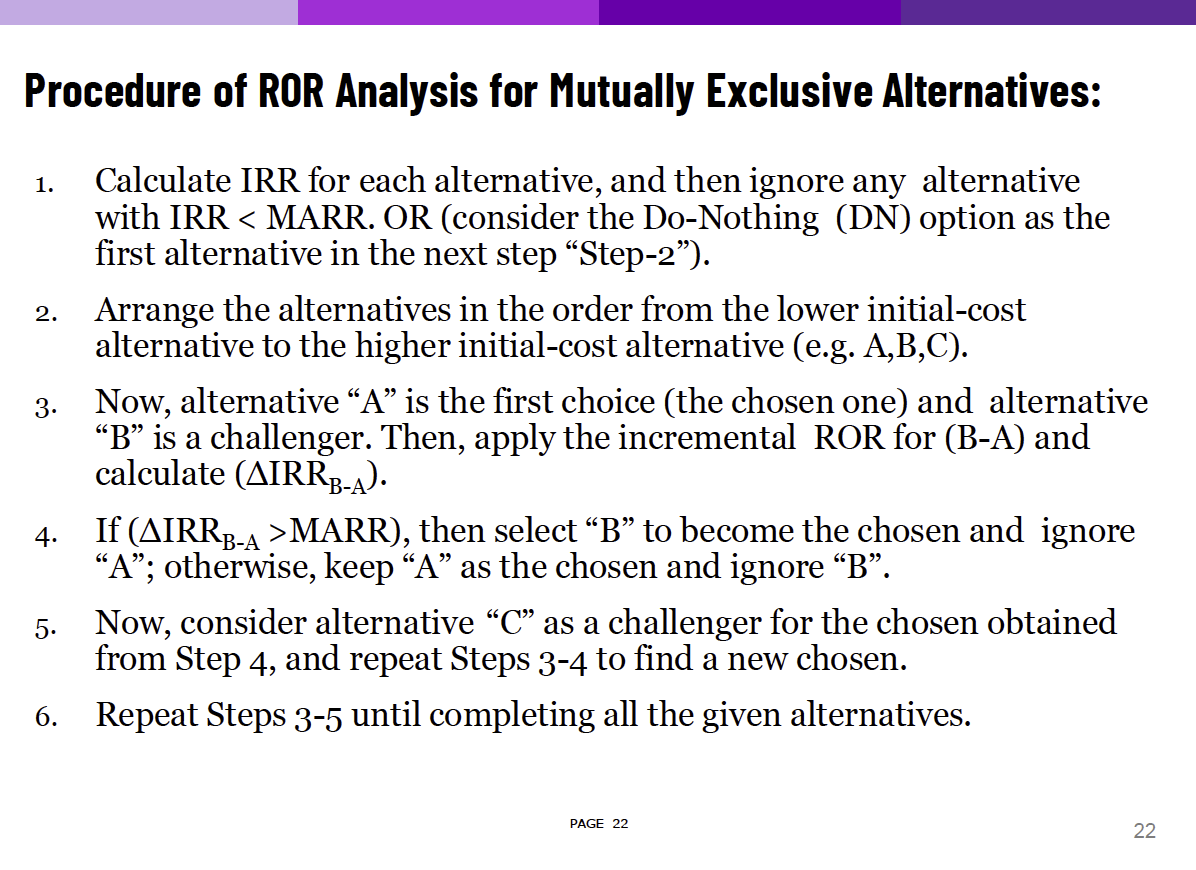

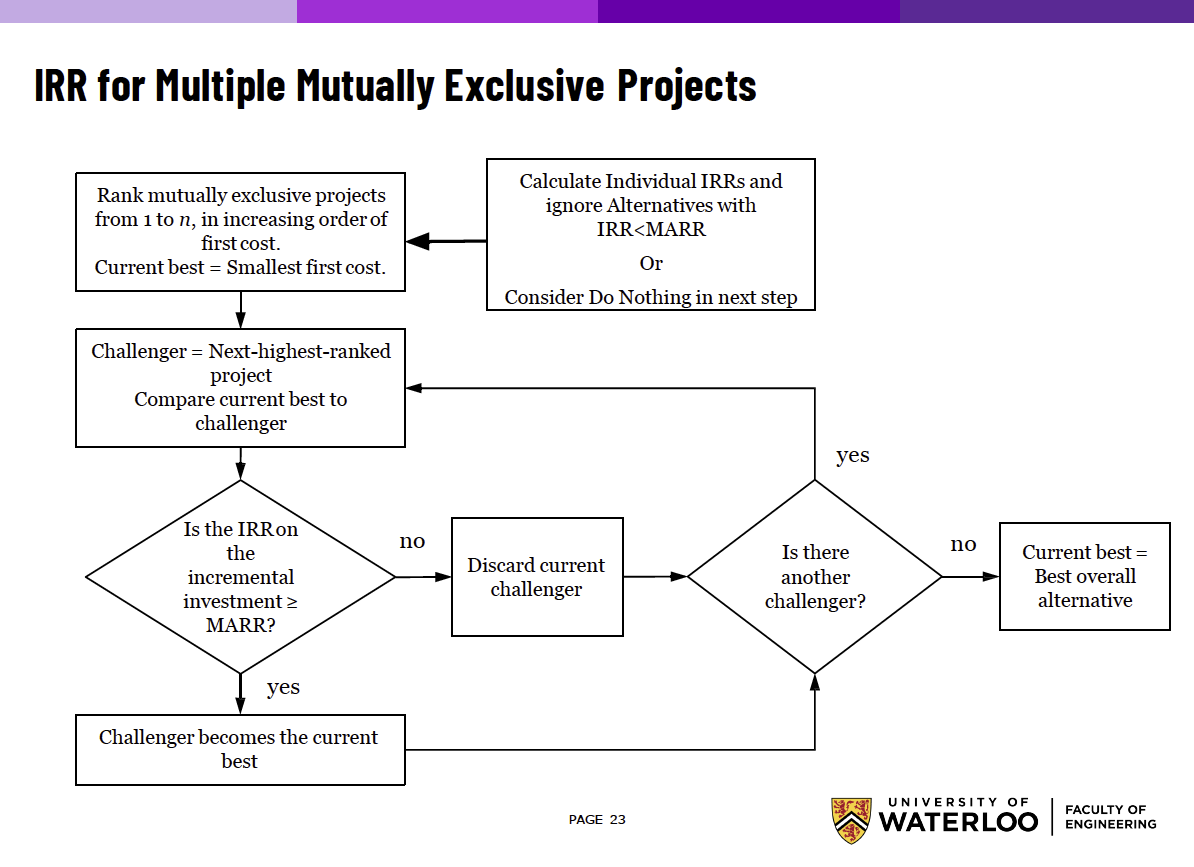

This part seems way to complicated?

- This diagram seems like a good explanation?

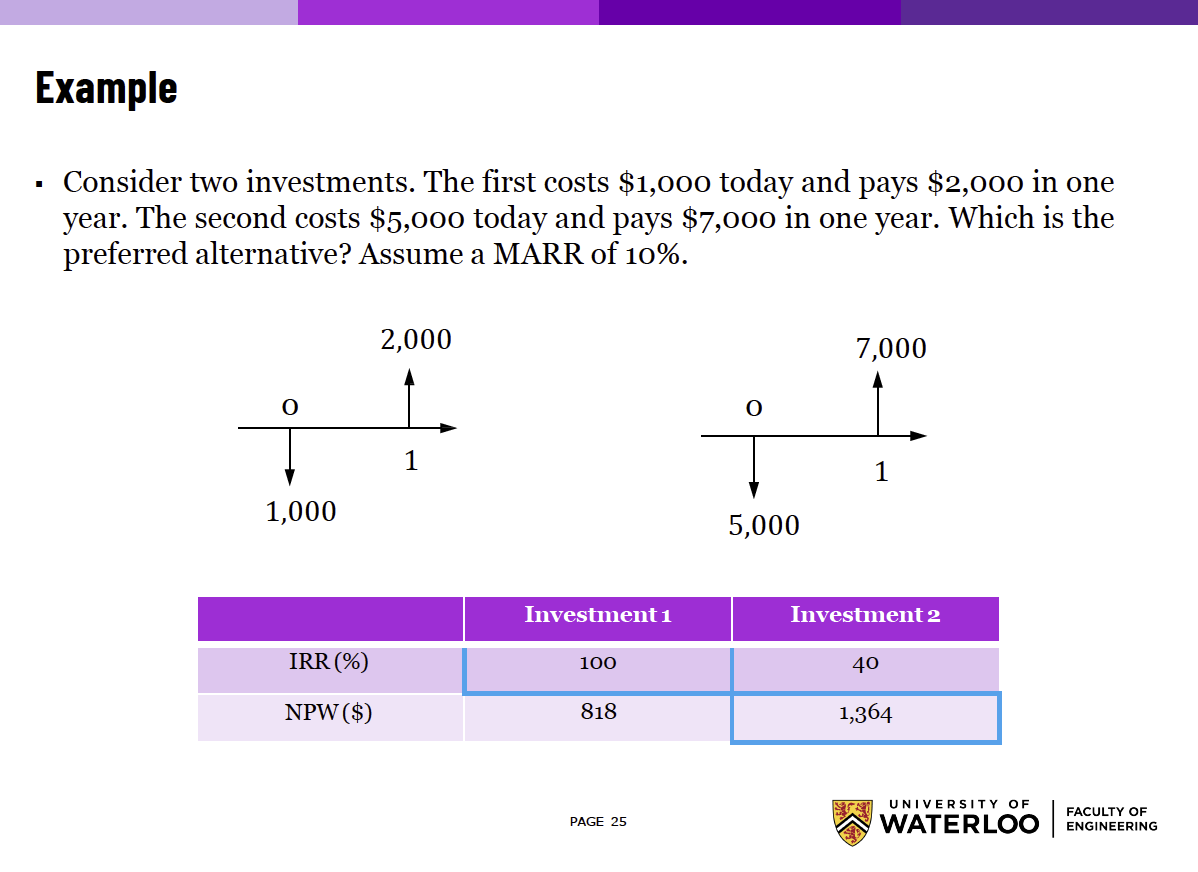

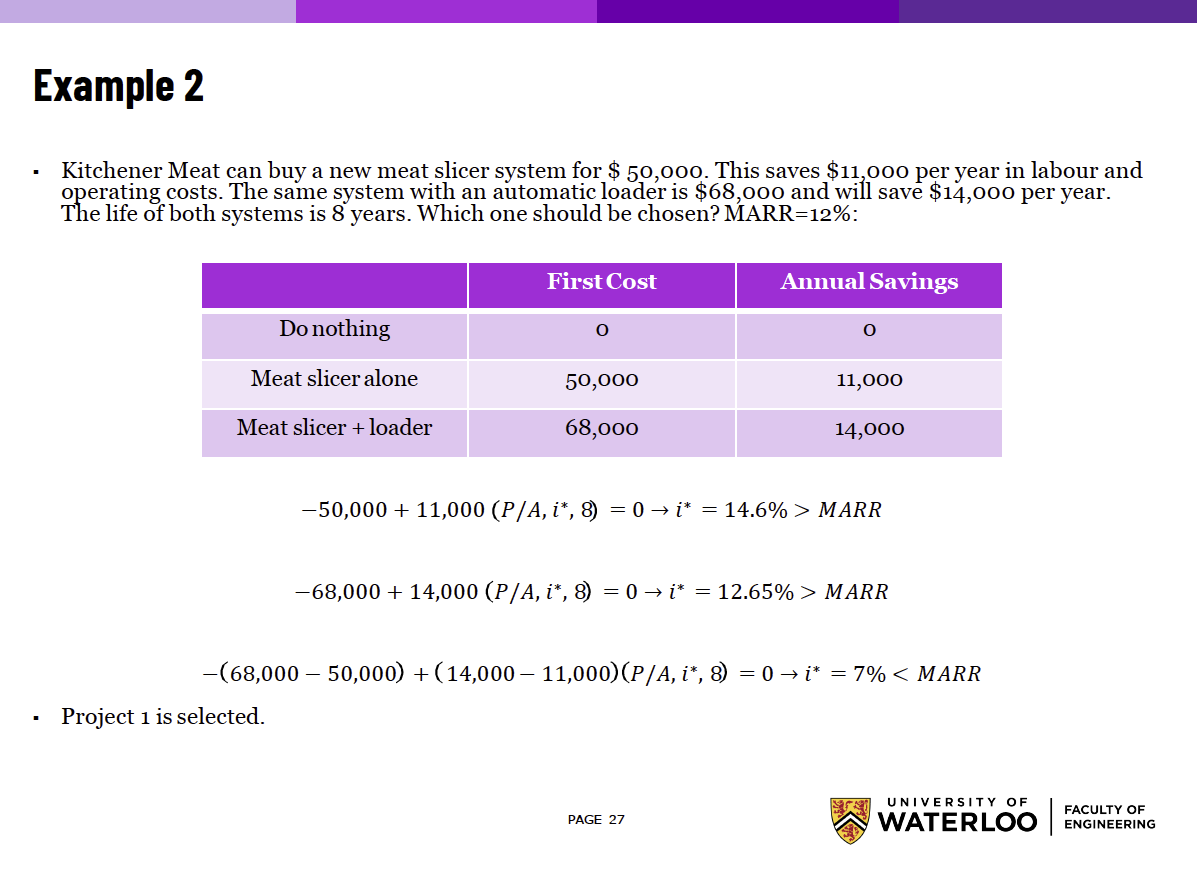

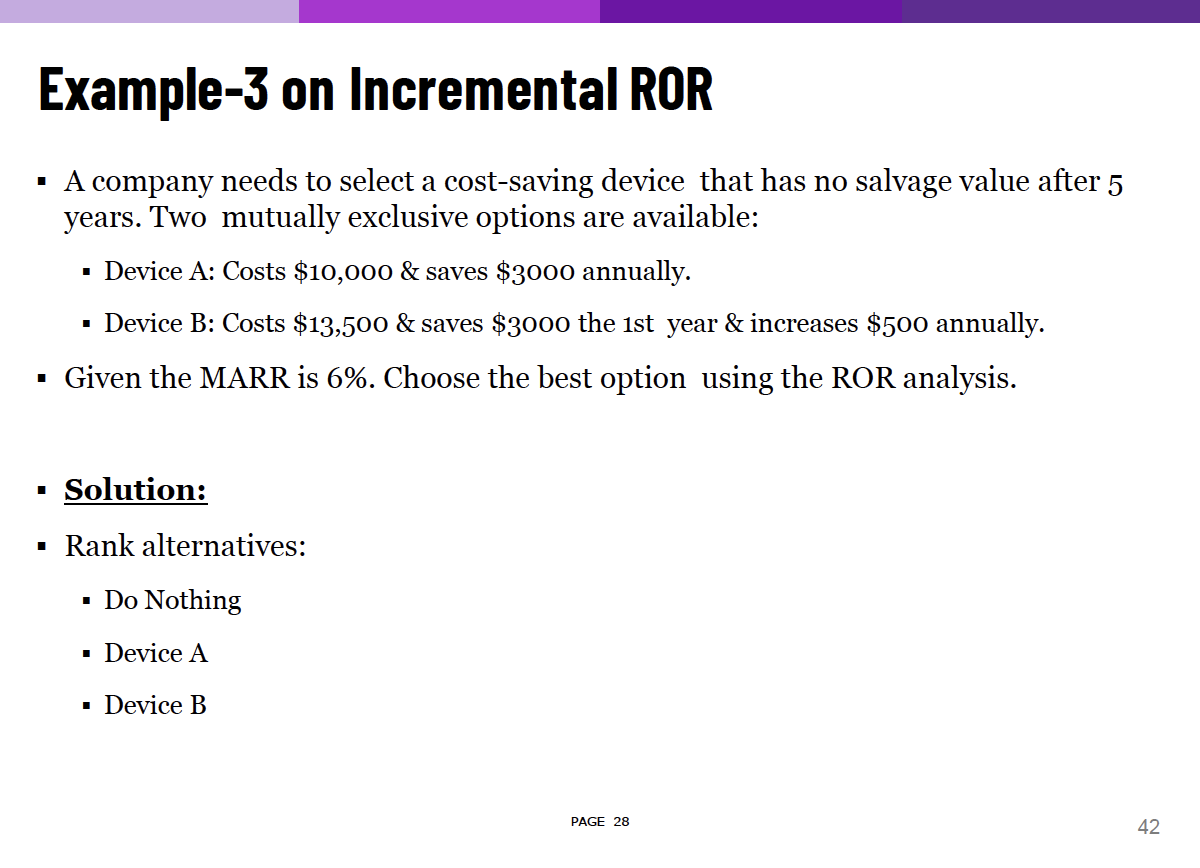

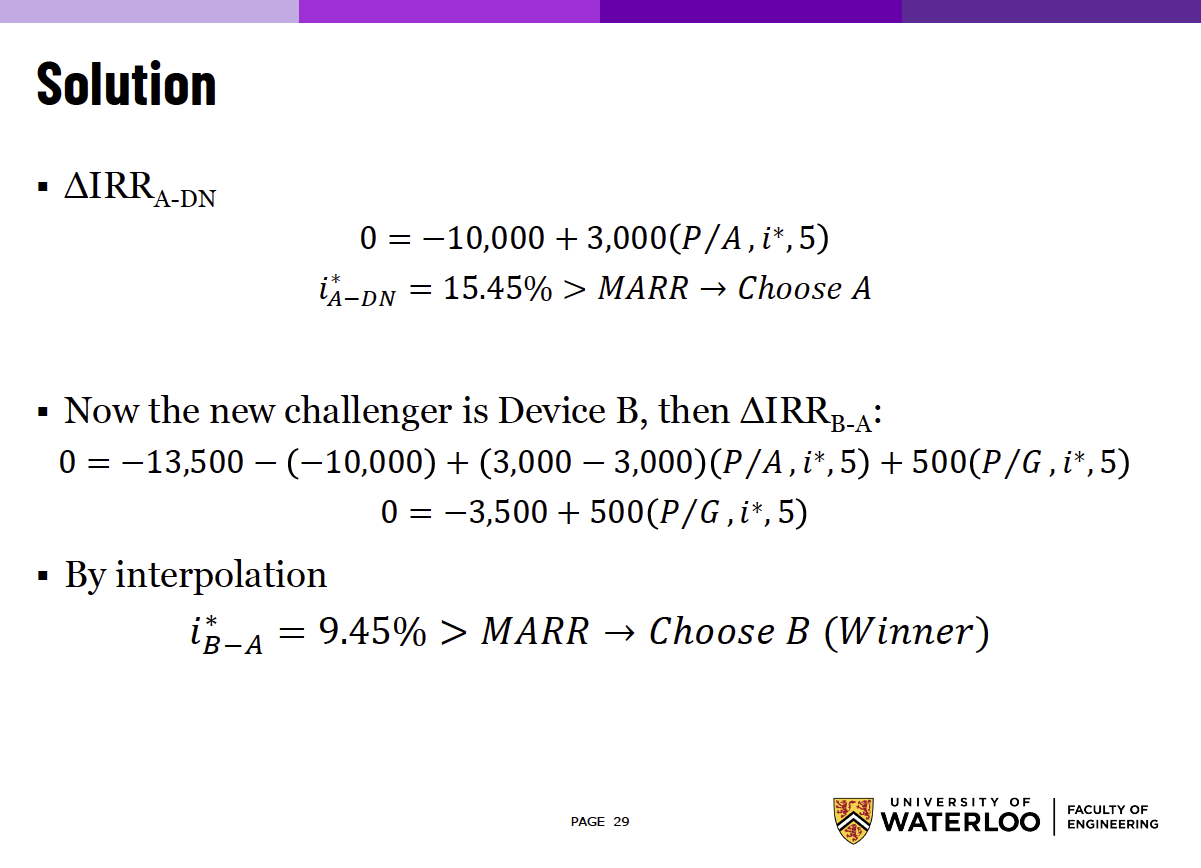

Examples

They use a pretty drawn out explanation for this first example.

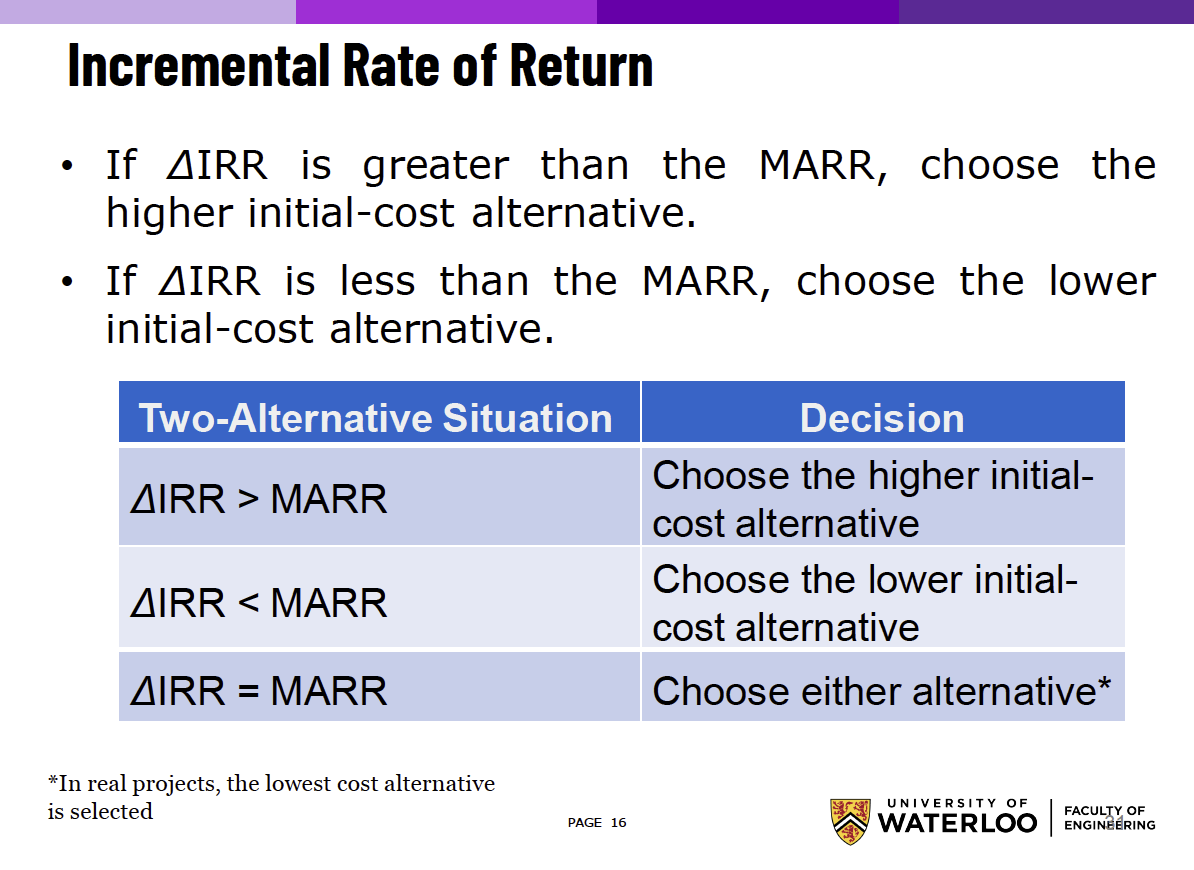

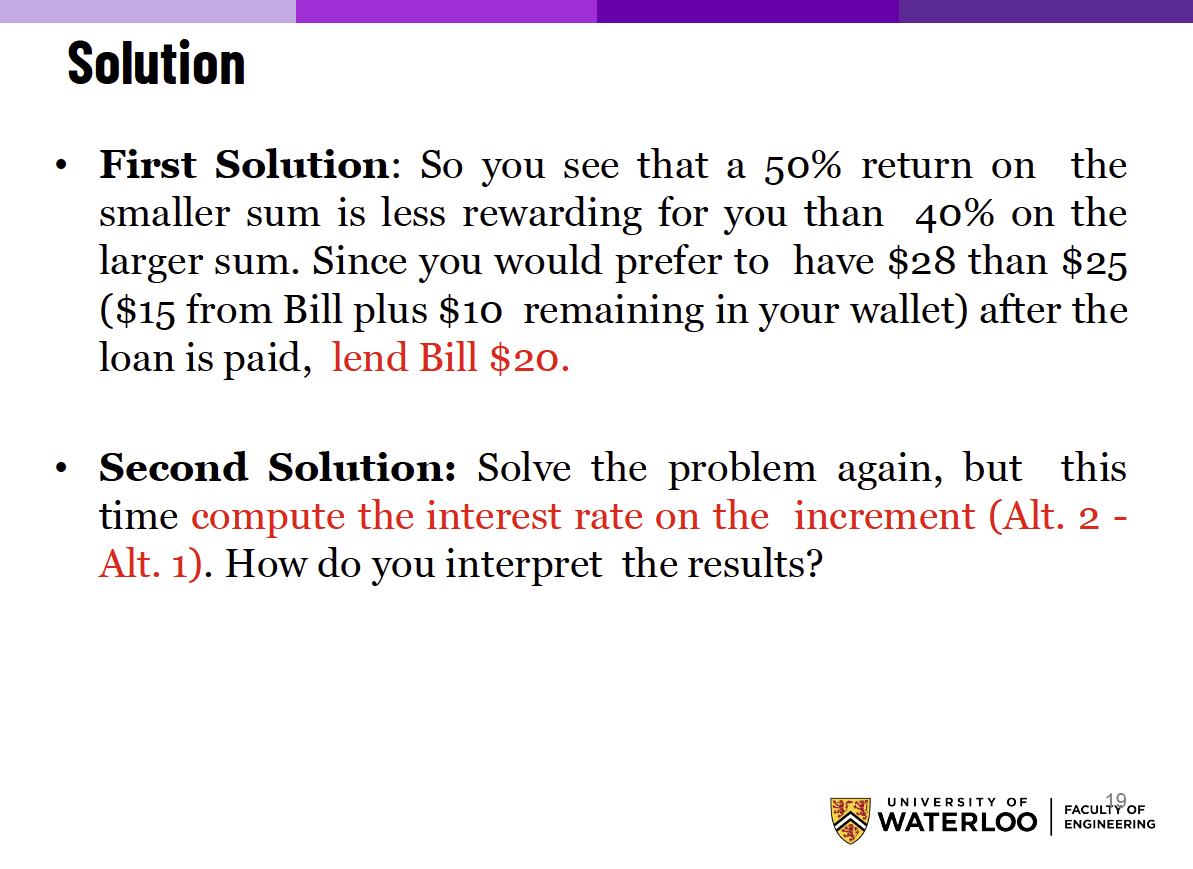

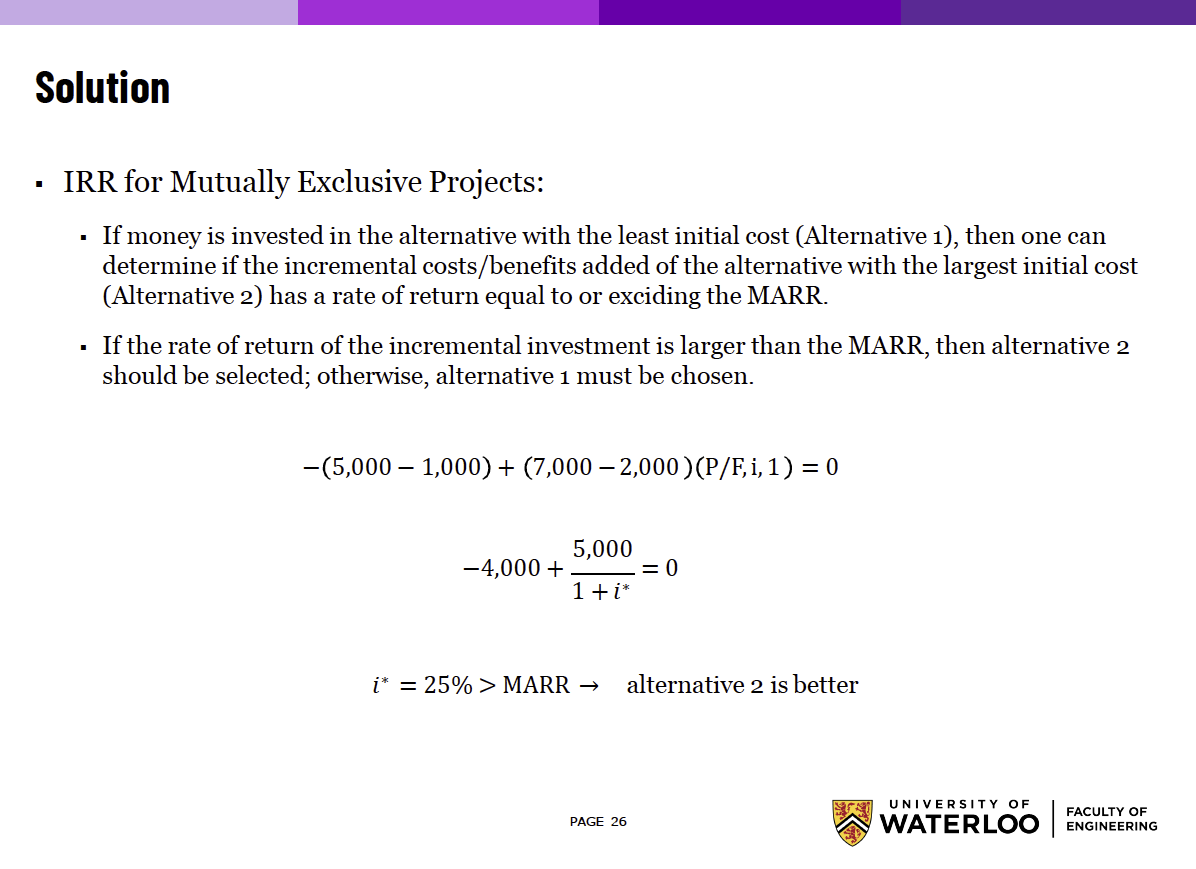

So I think the template is just to set project 1 as the one with the cheaper initial cost. Then, you calculate 3 different IRR, and see which one surpasses the MARR to make your decision.

- Actually, you only need to calculate the third one:

“If the rate of return of the incremental investment is larger than the MARR, then alternative 2 should be selected; otherwise, alternative 1 must be chosen.”

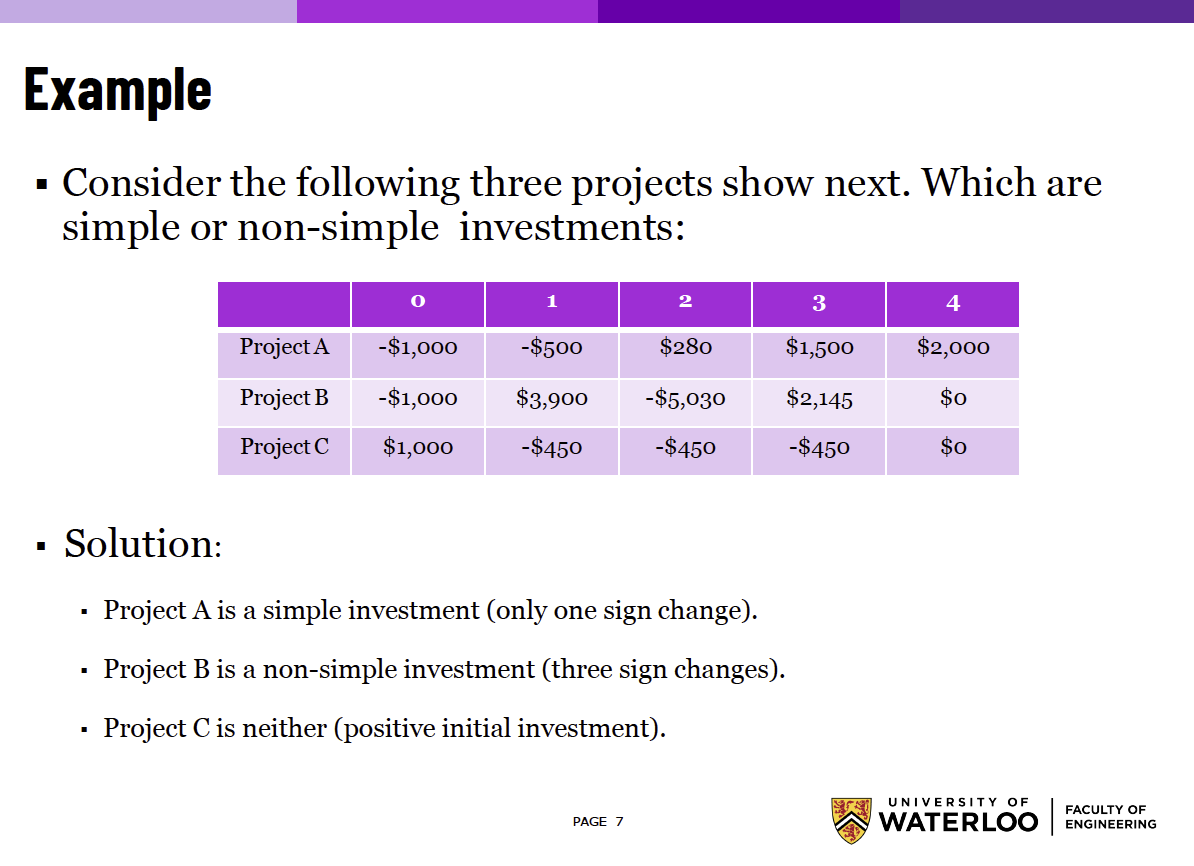

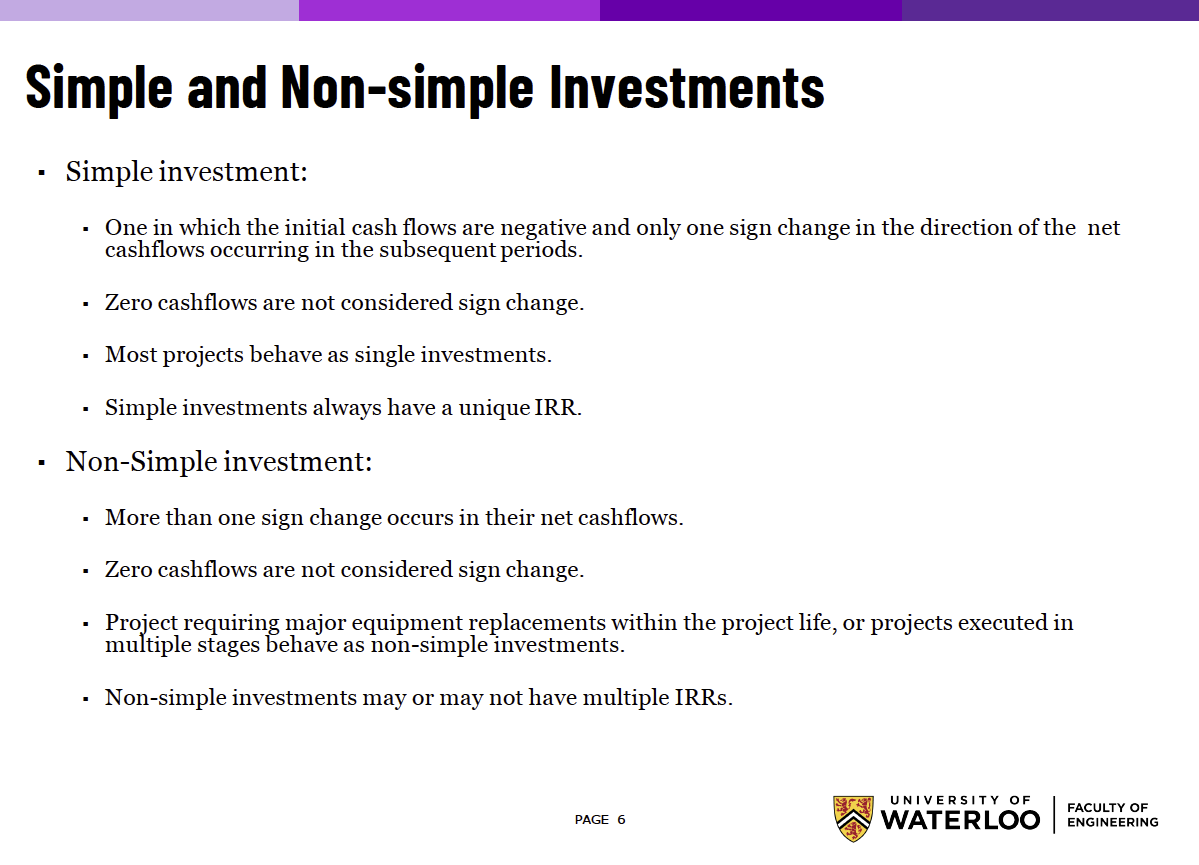

Multiple IRR

Make sure to wrap your head around this: