Worth Analysis

Learned in ECE192.

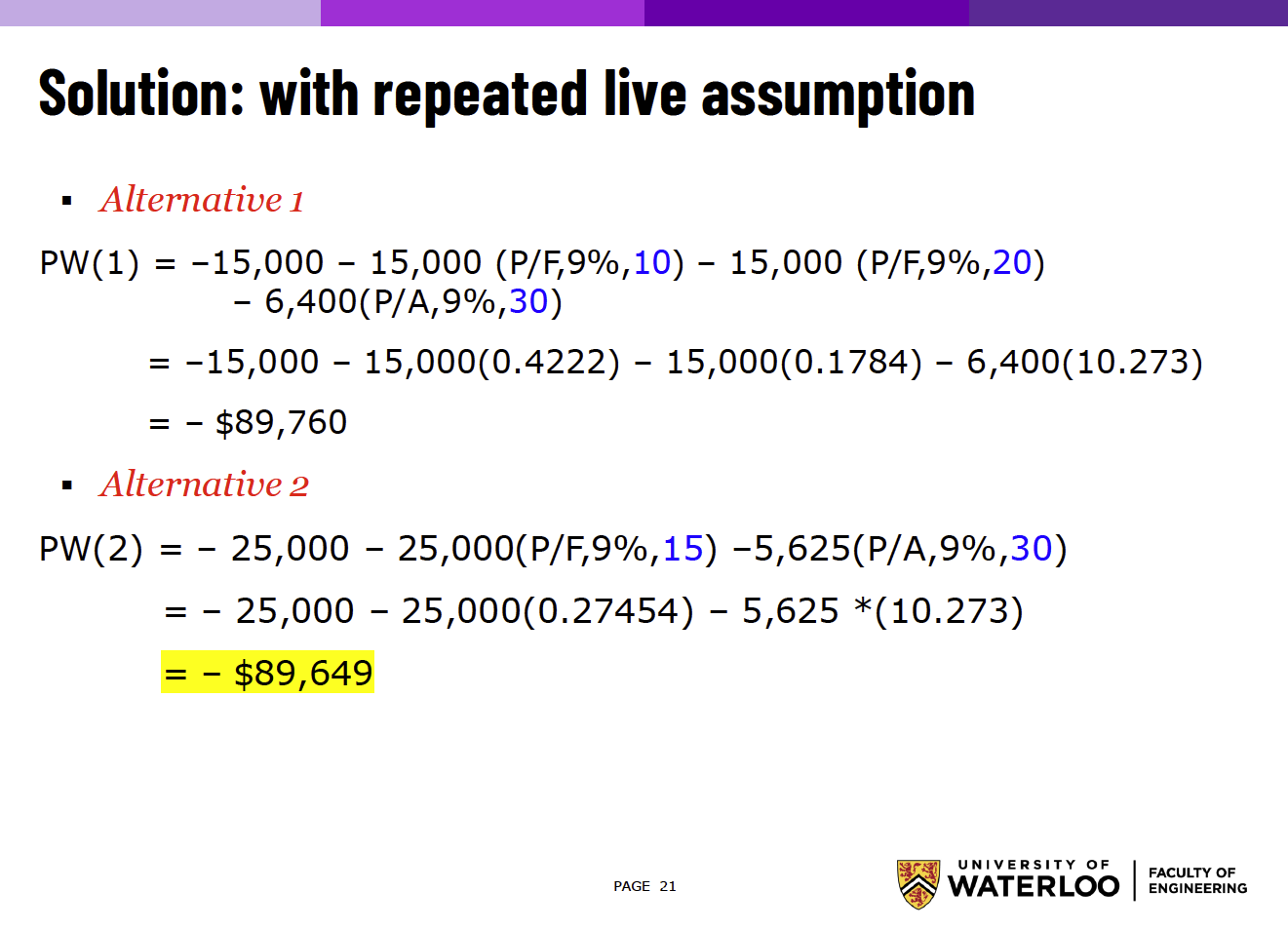

Present Worth Analysis

This is just using the Present Worth Factor.

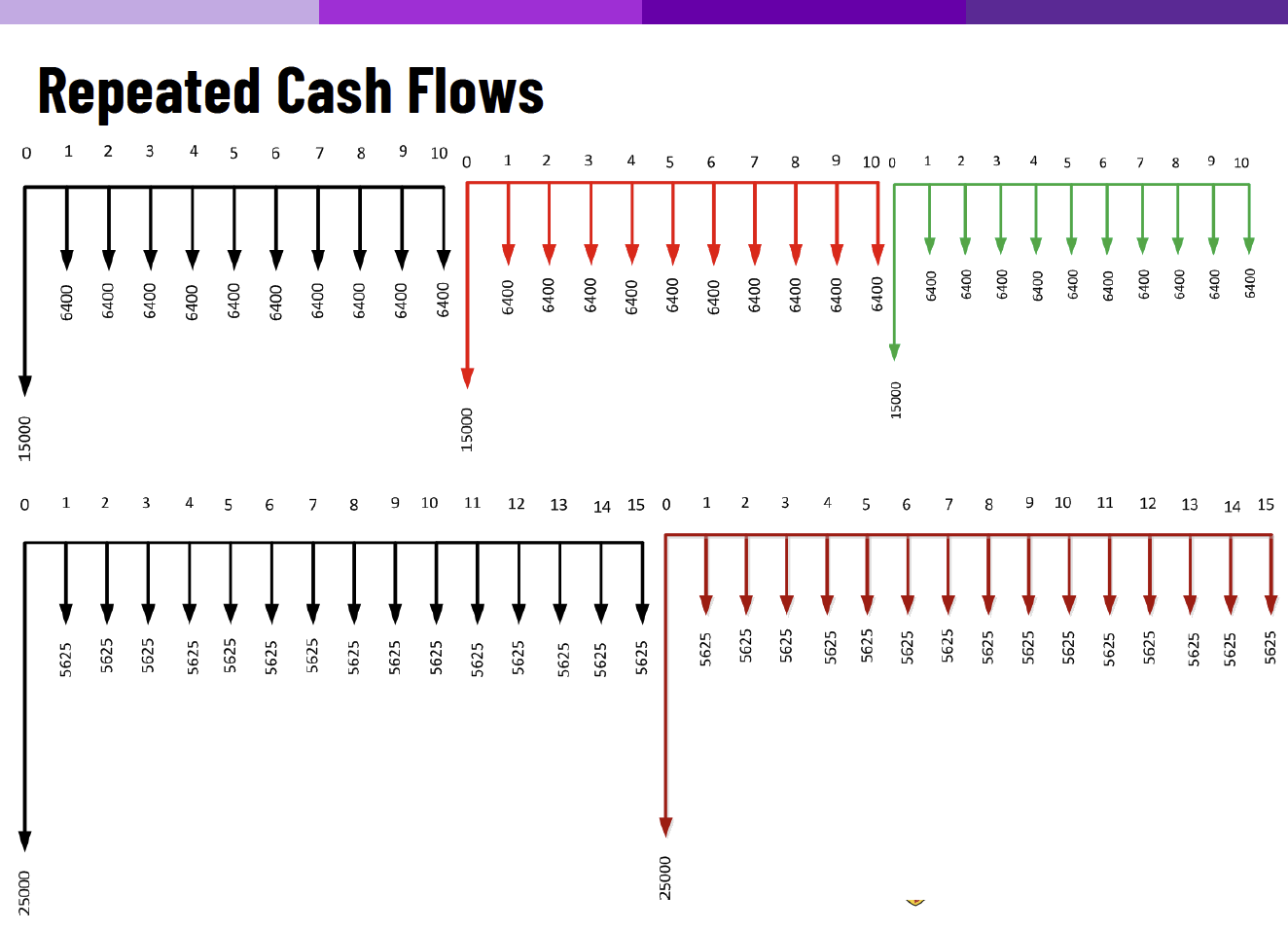

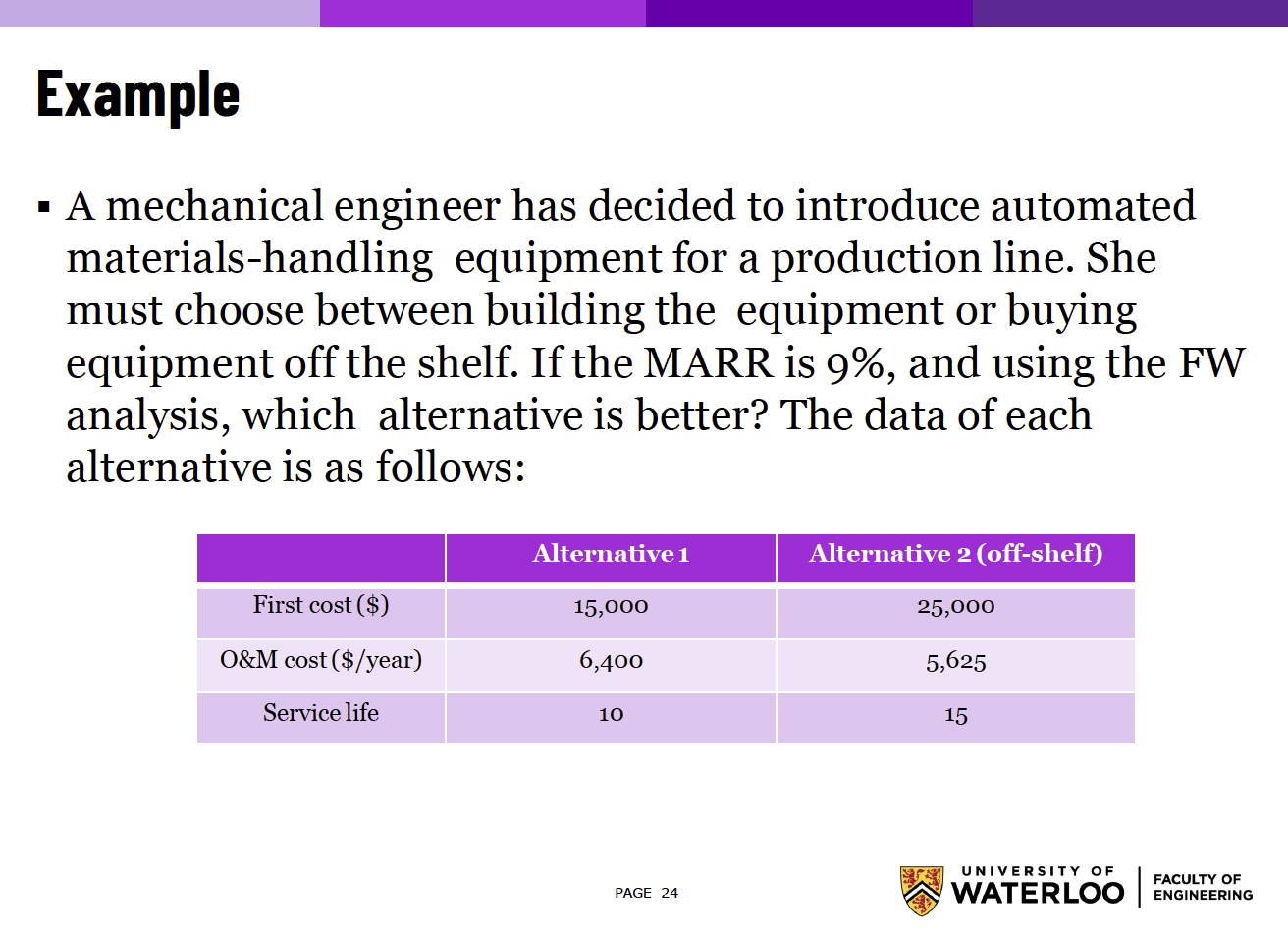

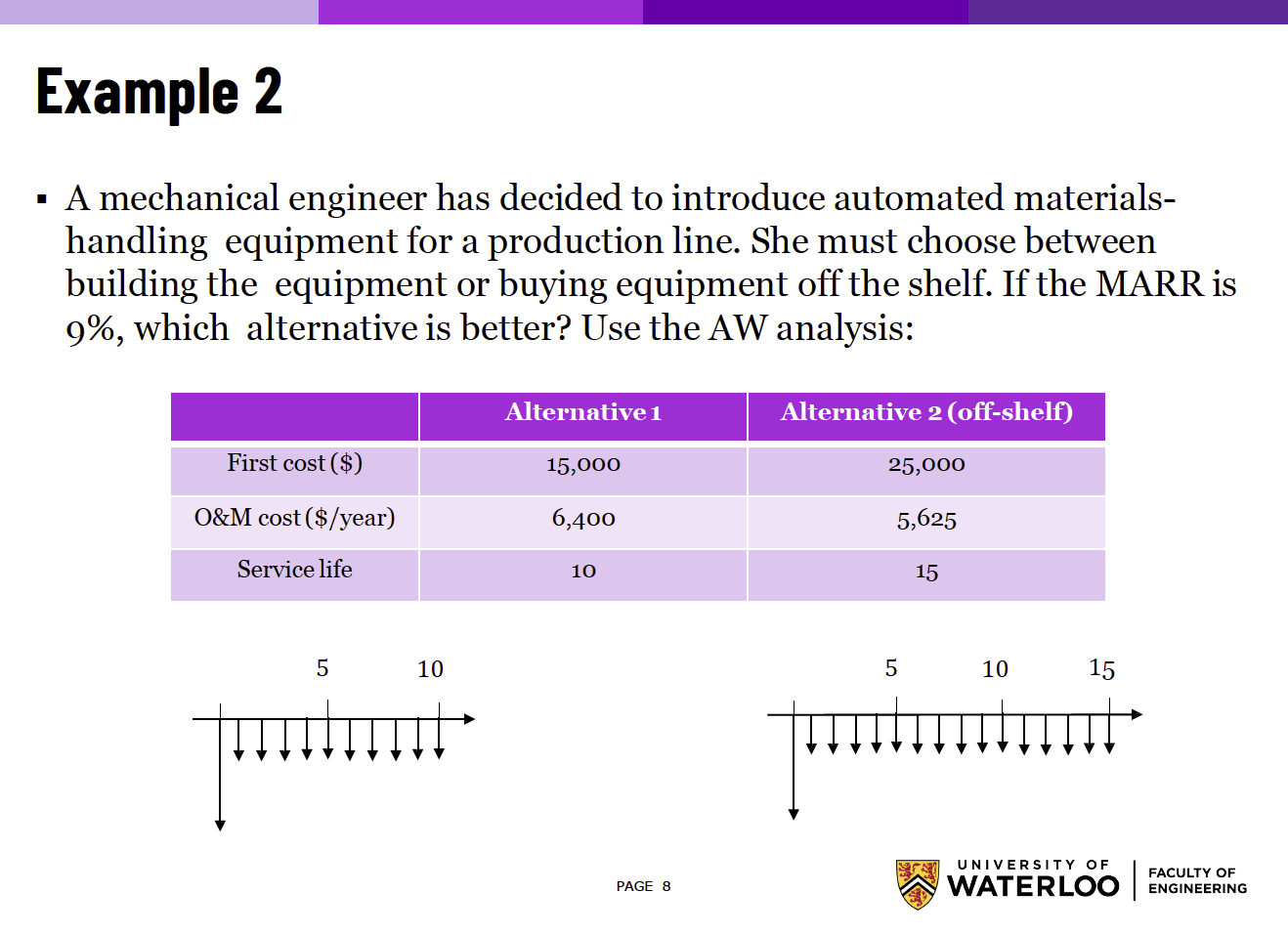

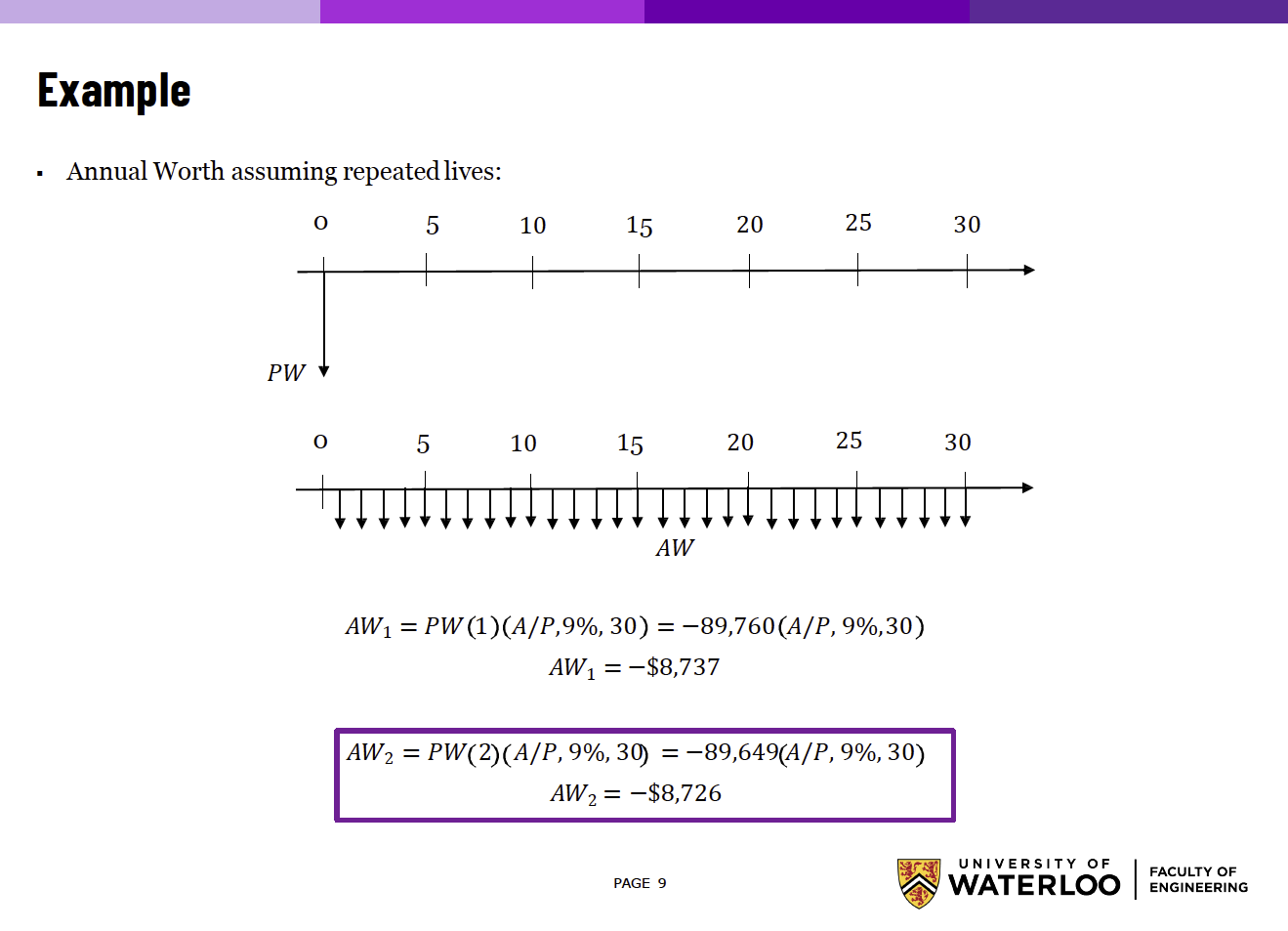

You need to be very careful because both alternatives have different service lives (pages 17-19 show the wrong calculations). We need to apply the repeated lives method to get a fair comparison.

Just visualize the following cash flow diagram:

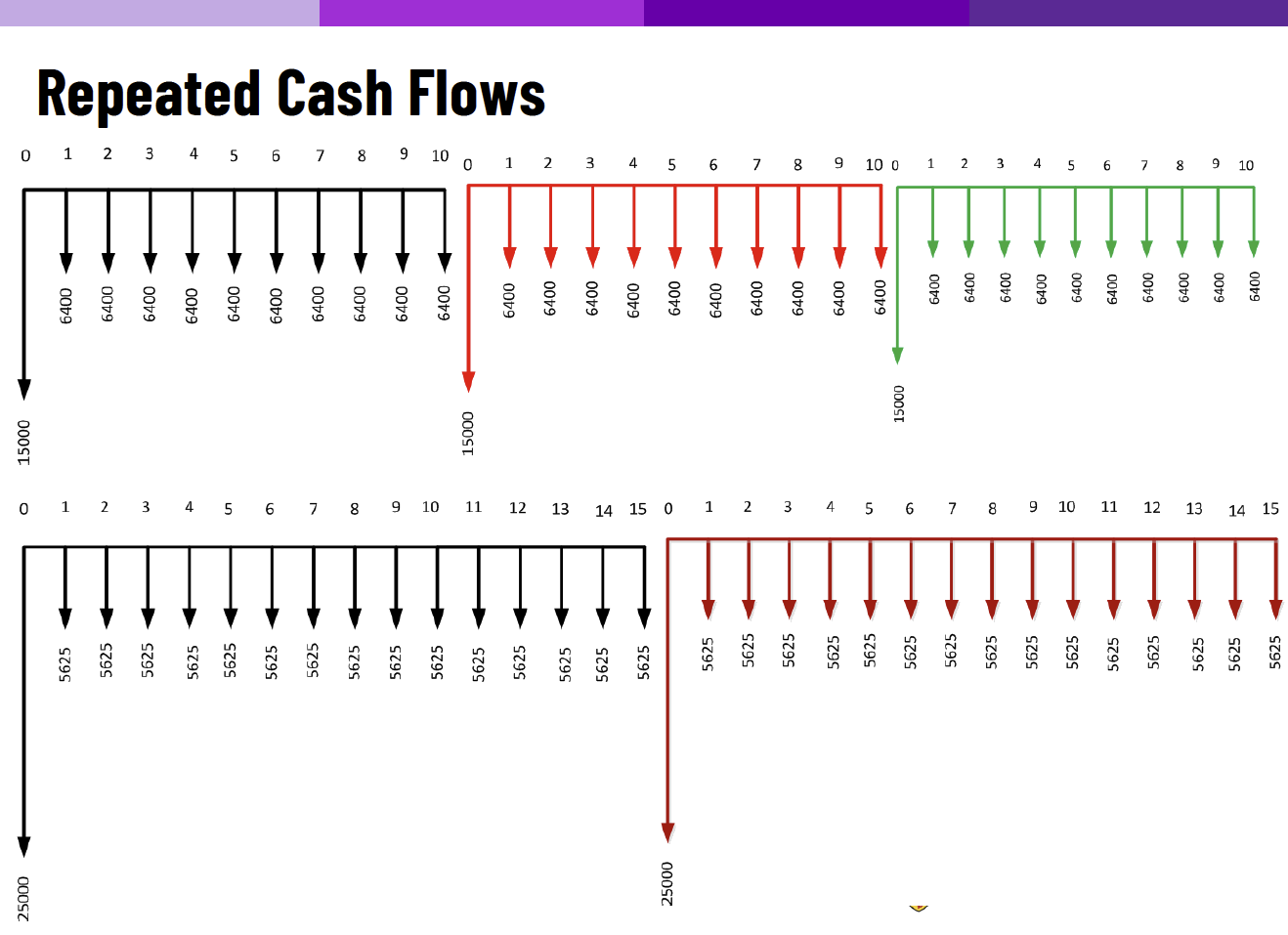

Future Worth Analysis

This is just using the Compound Amount Factor.

Example is super similar, just need to be careful to wrap your head around the calculation.

- Everything is relative to the future, so you don’t need to worry about calculating in terms of the present. This was confusing to me for the $15,000 cost

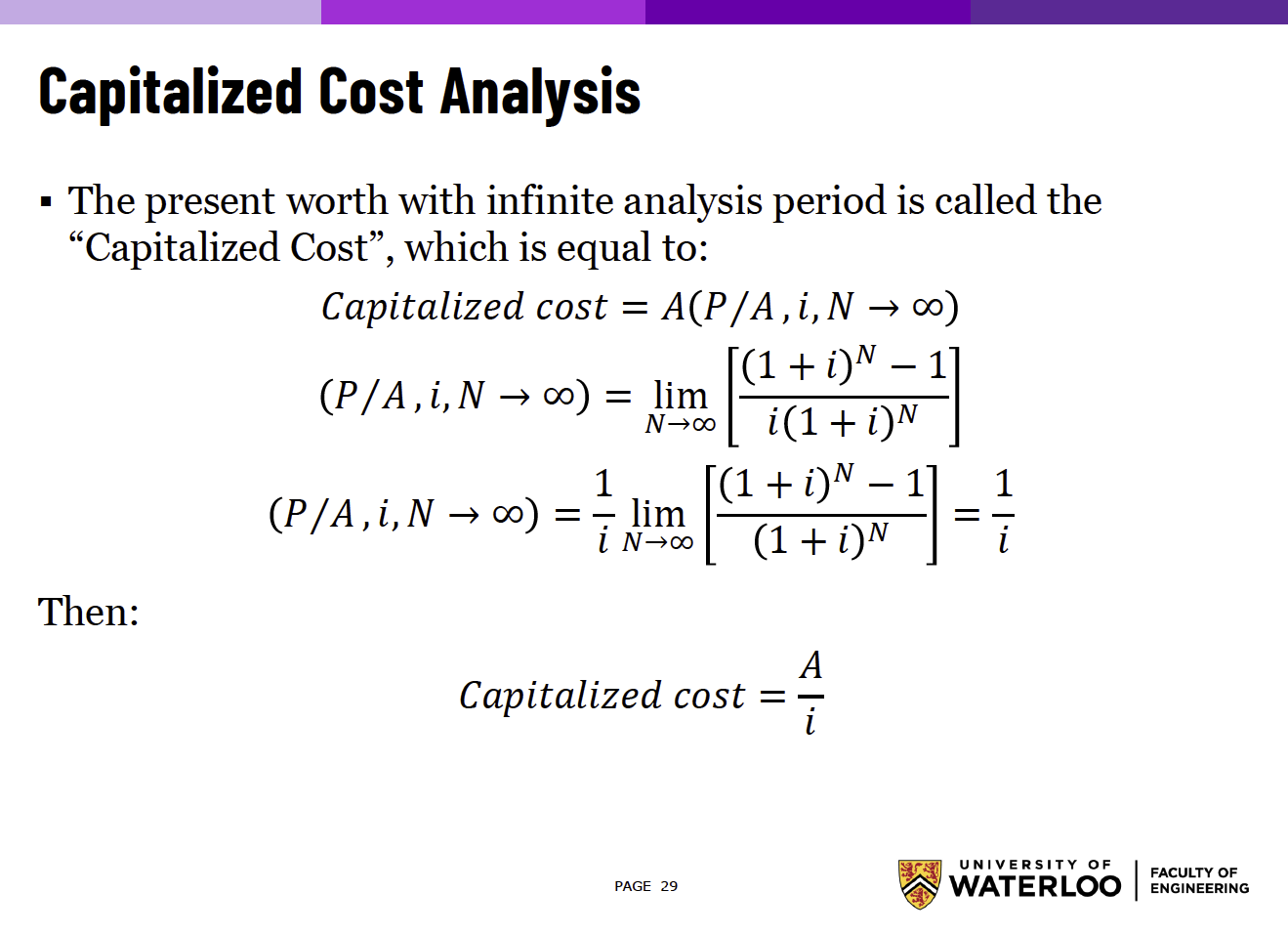

Capitalized Cost Analysis

This is so easy. It’s basically the Series Present Worth Factor where .

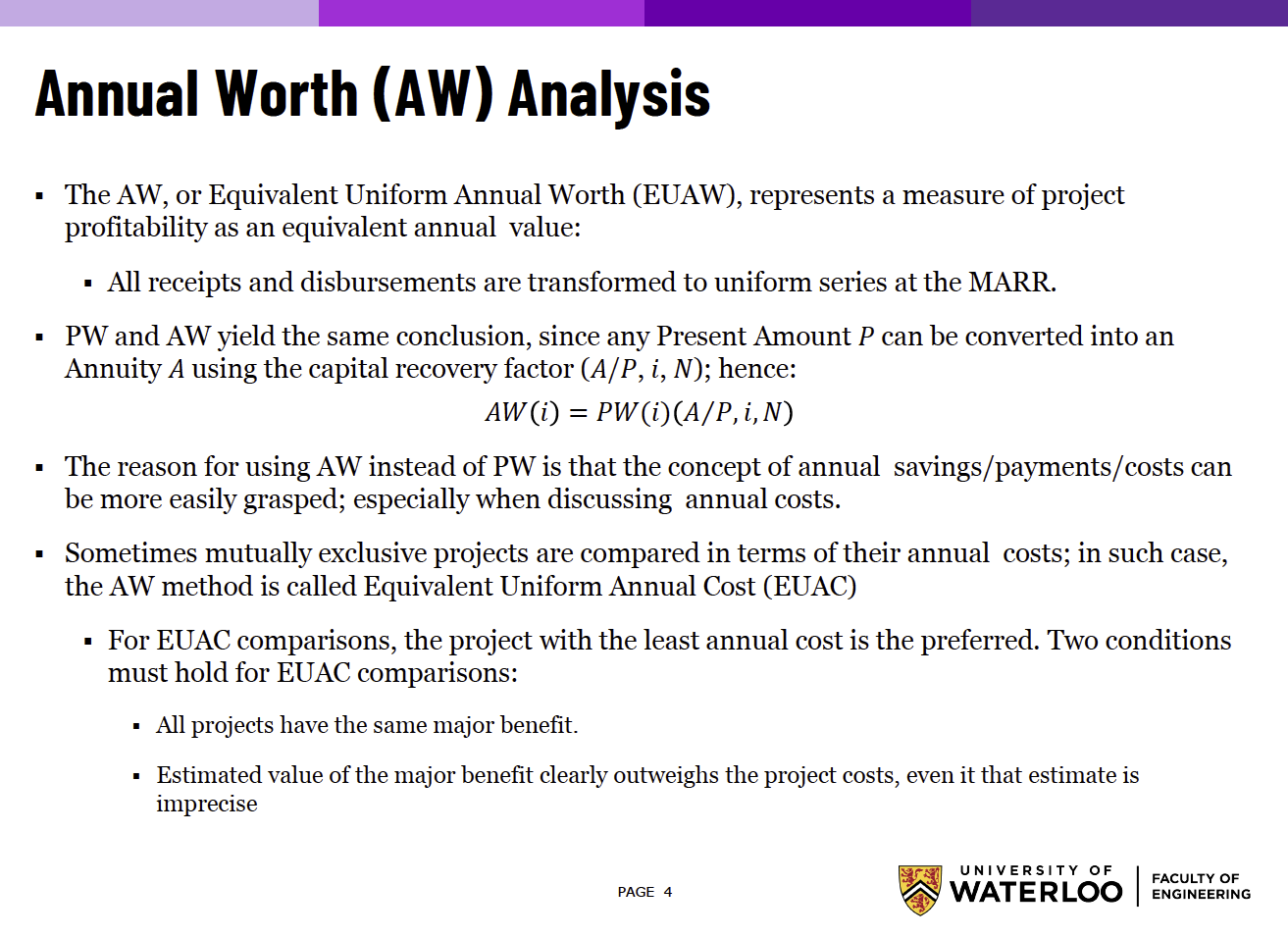

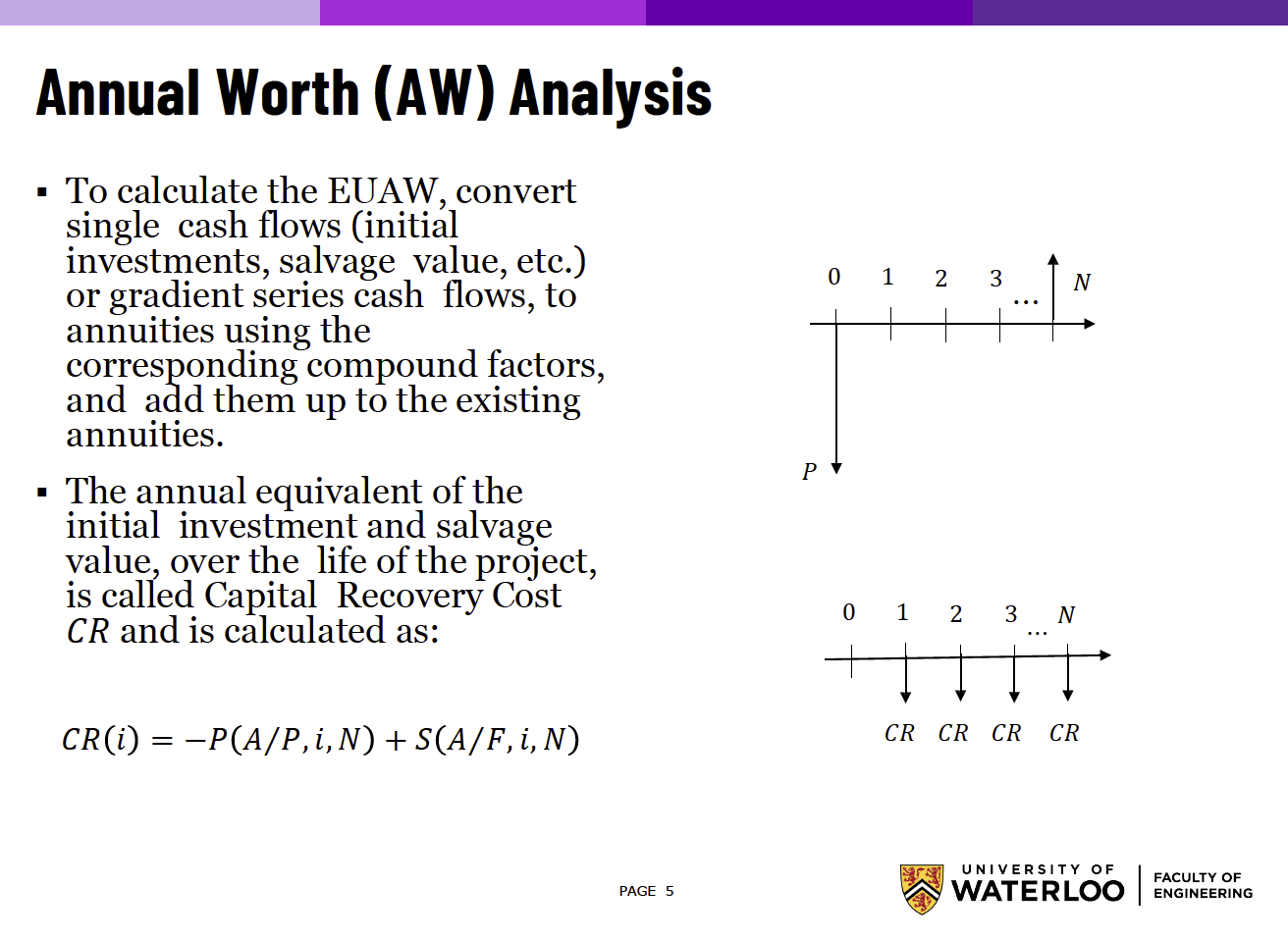

Annual Worth Analysis

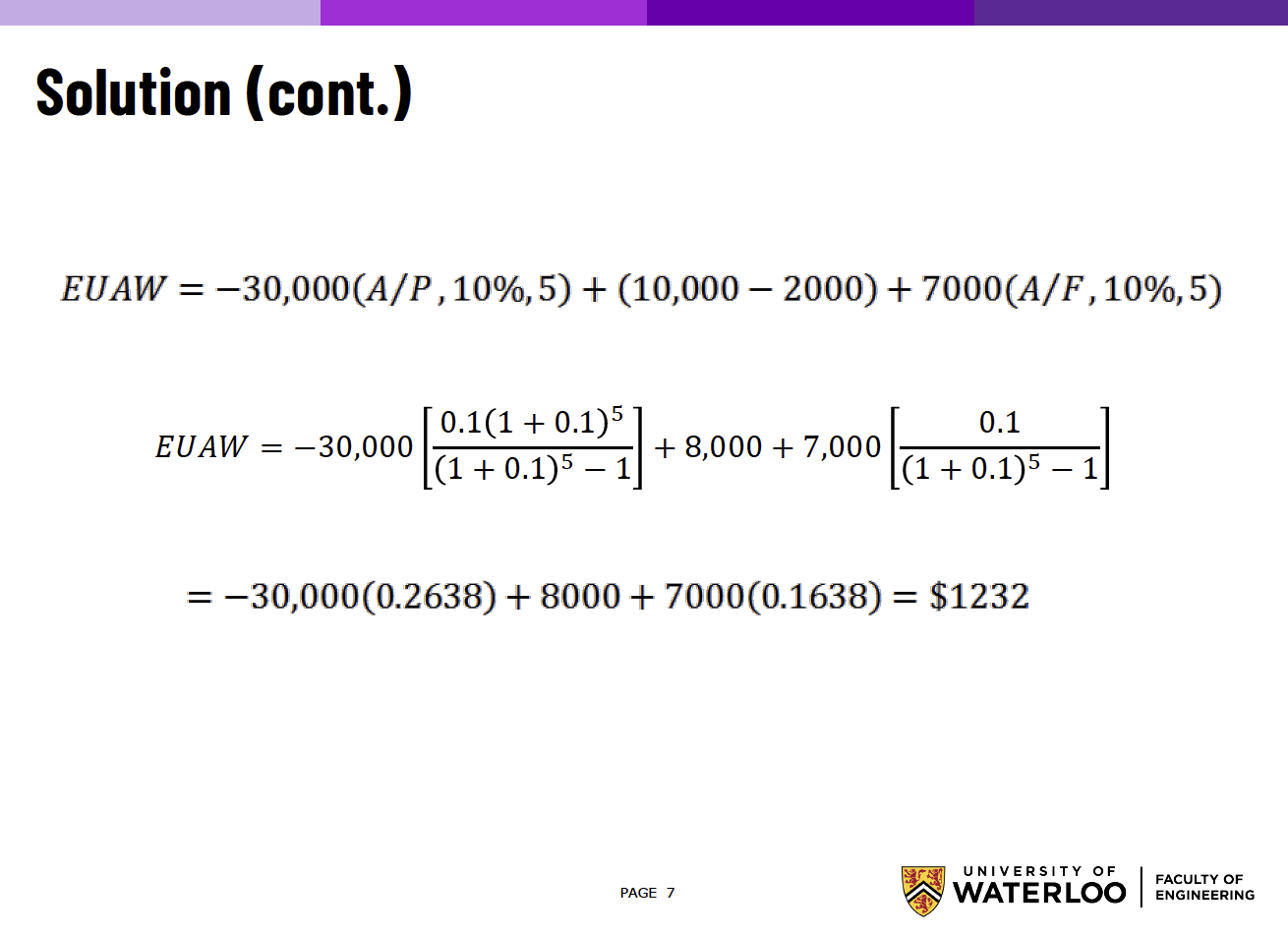

The AW, or Equivalent Uniform Annual Worth (EUAW), represents a measure of project profitability as an equivalent annual value.

This is basically using Capital Recovery Factor.

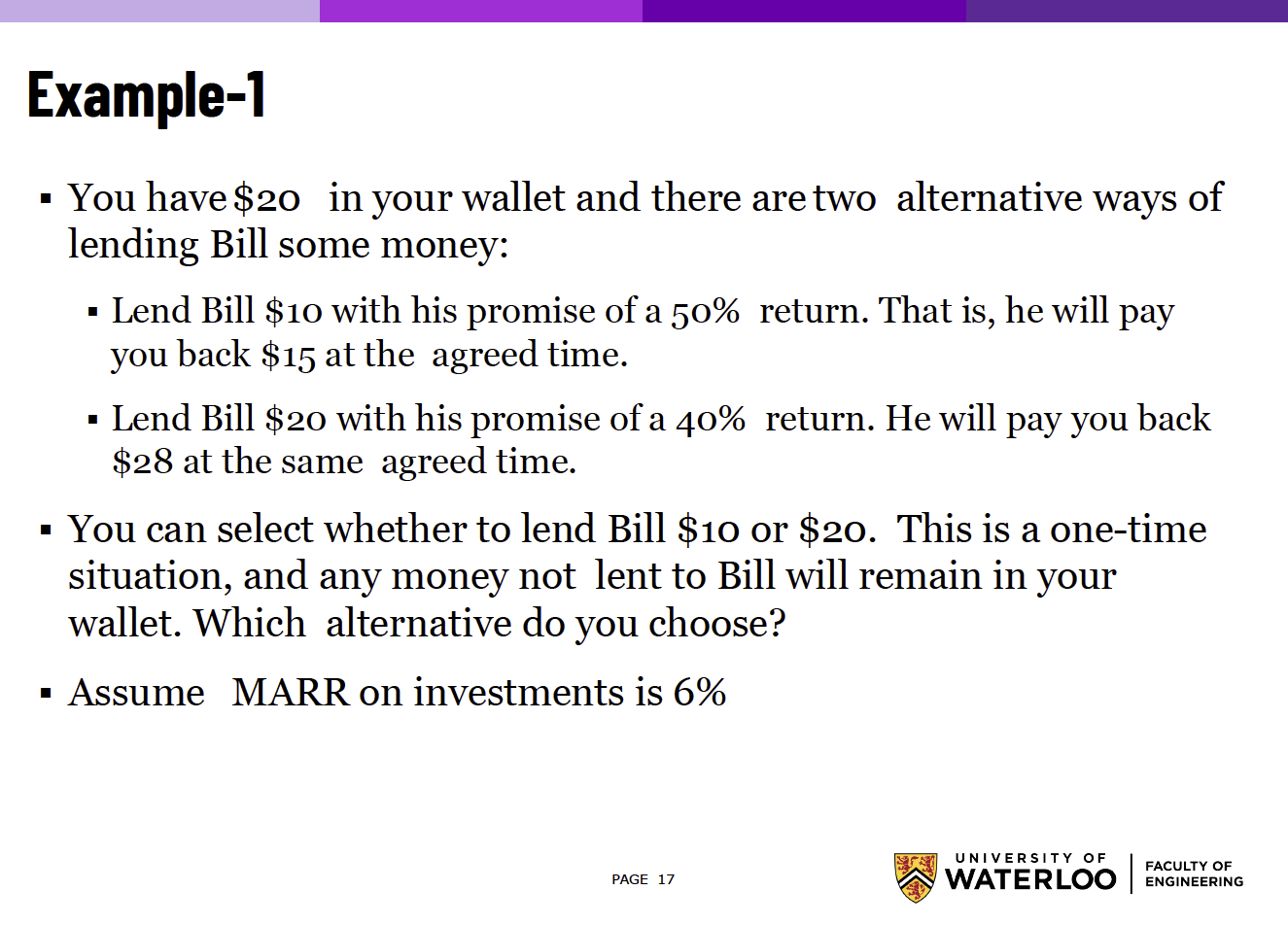

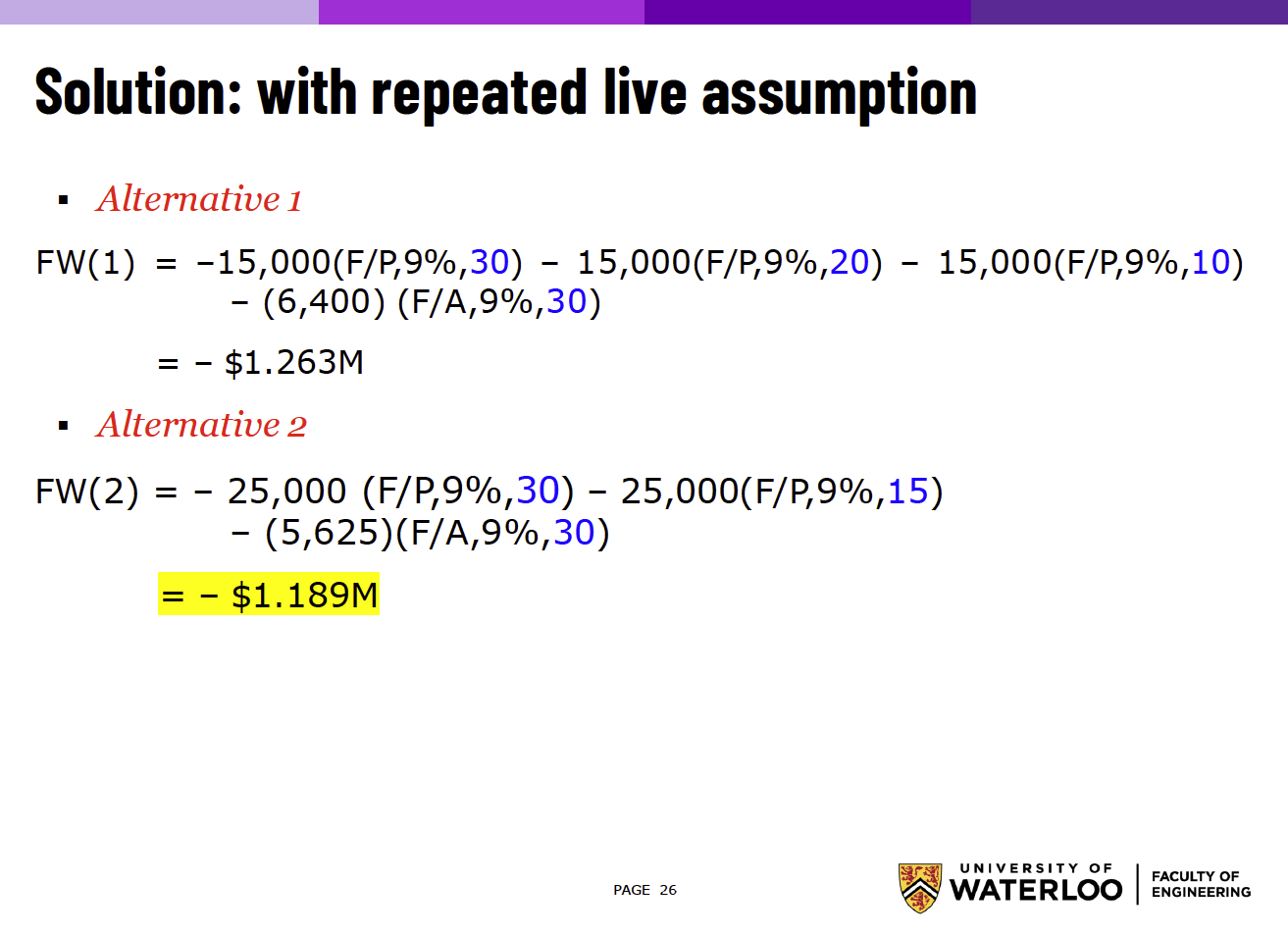

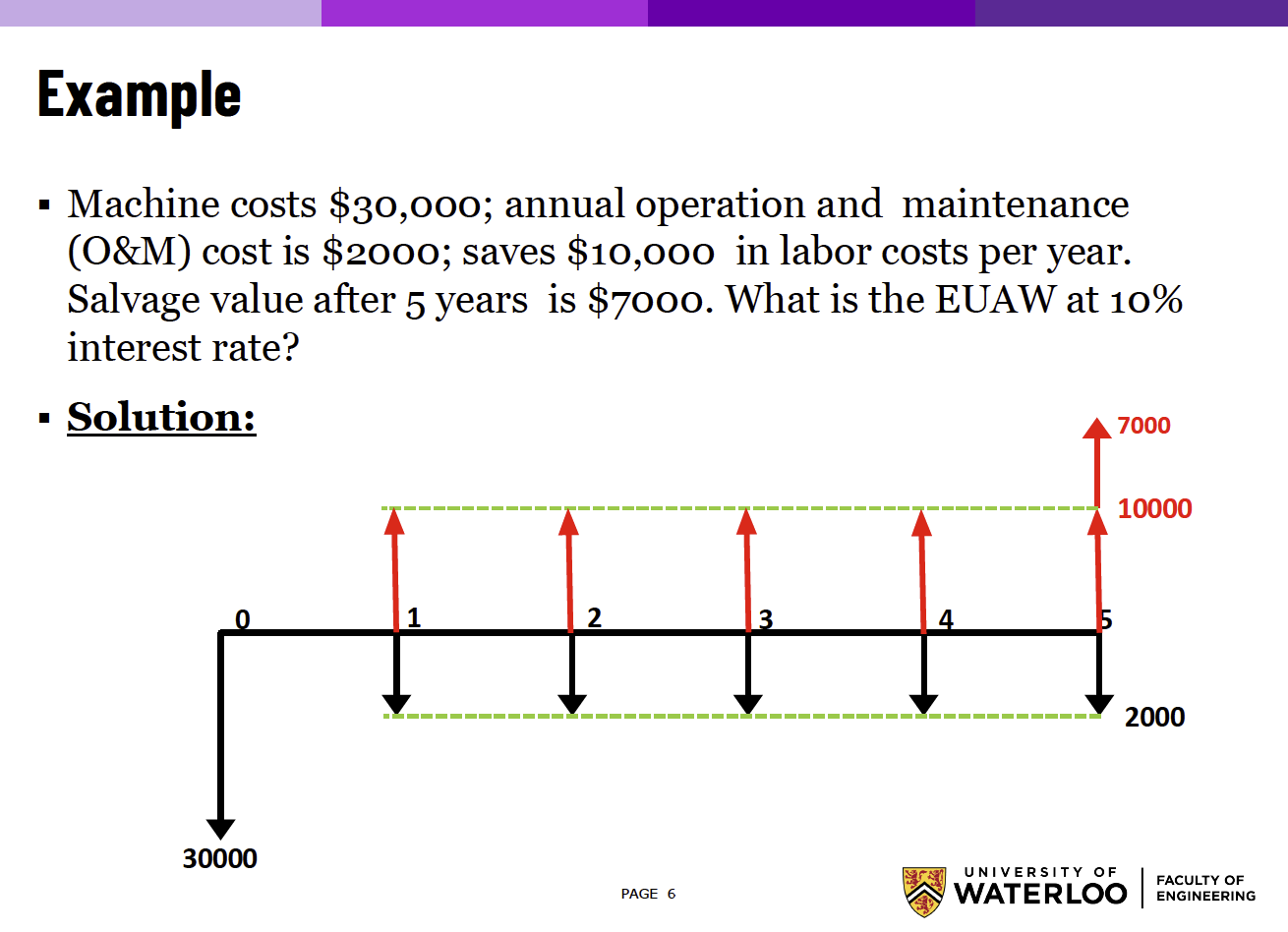

Example

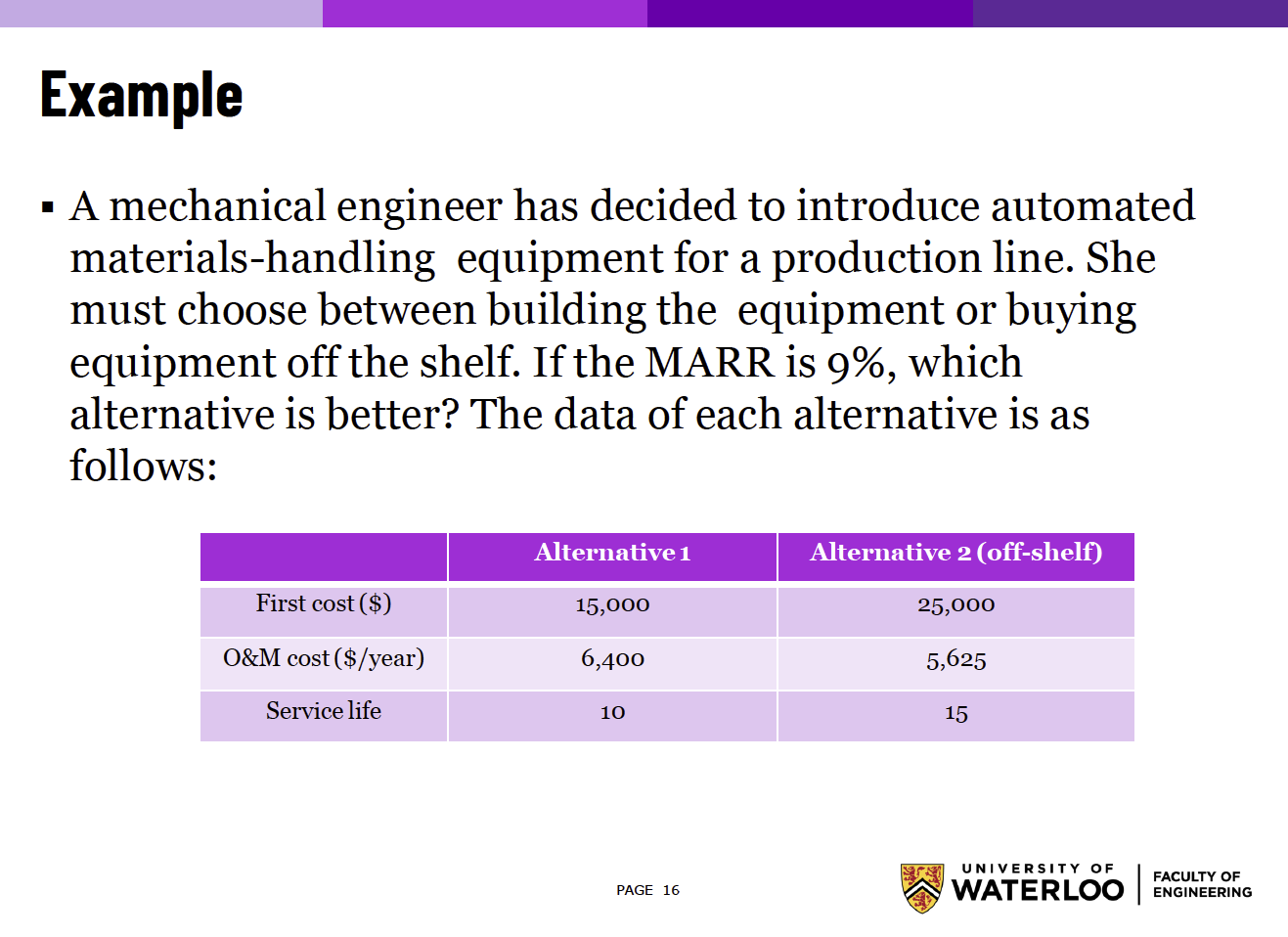

Another example:

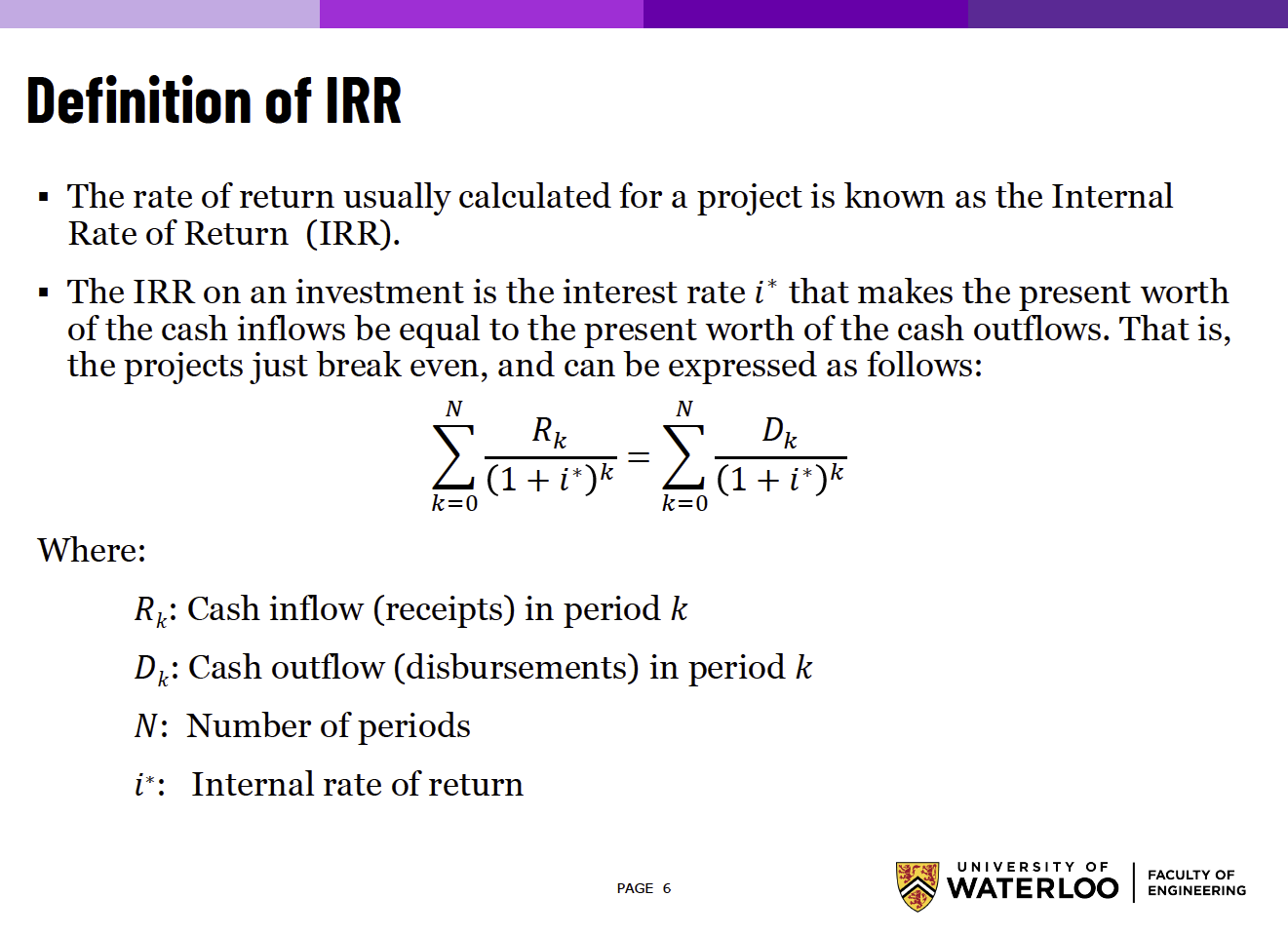

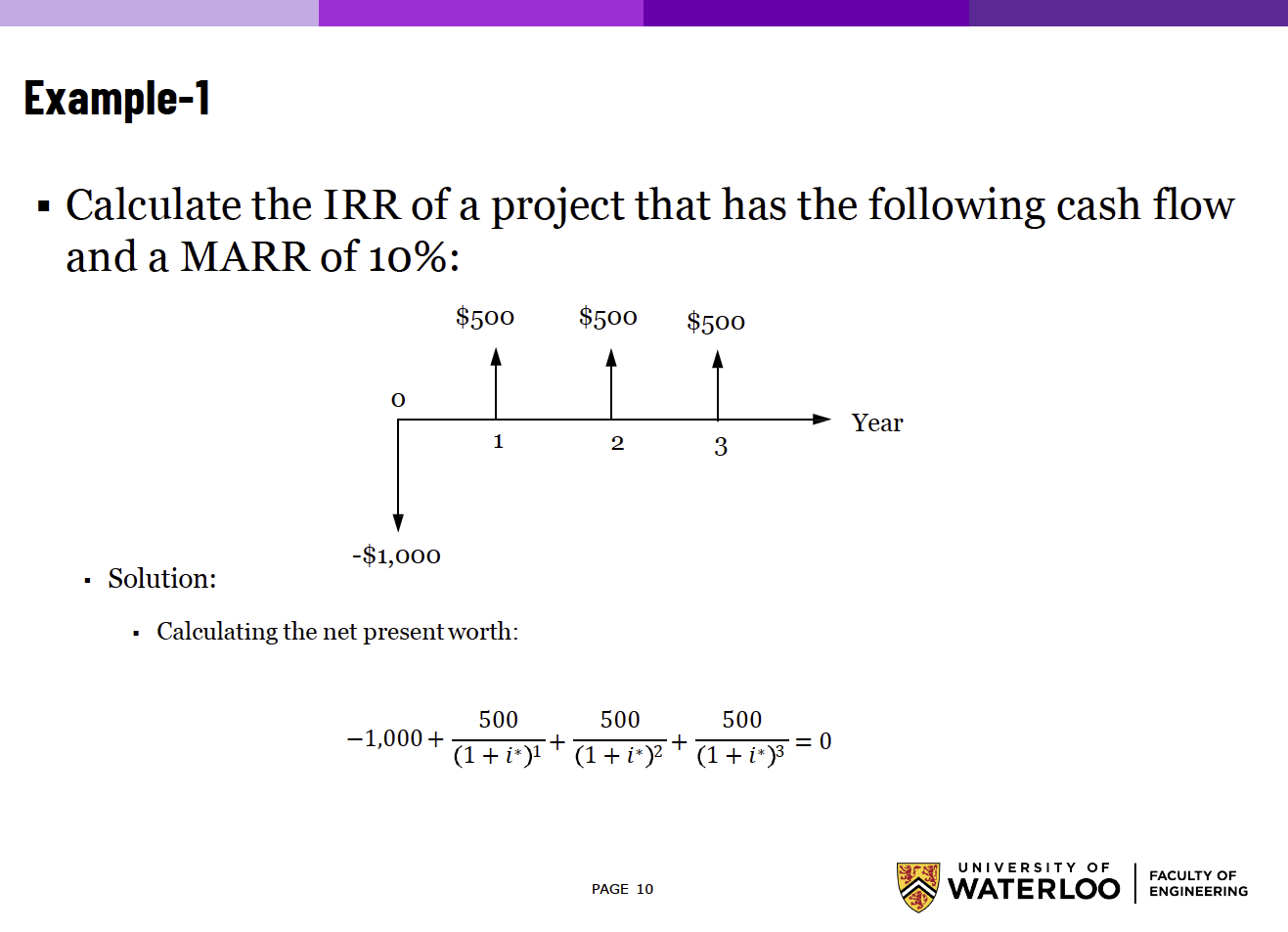

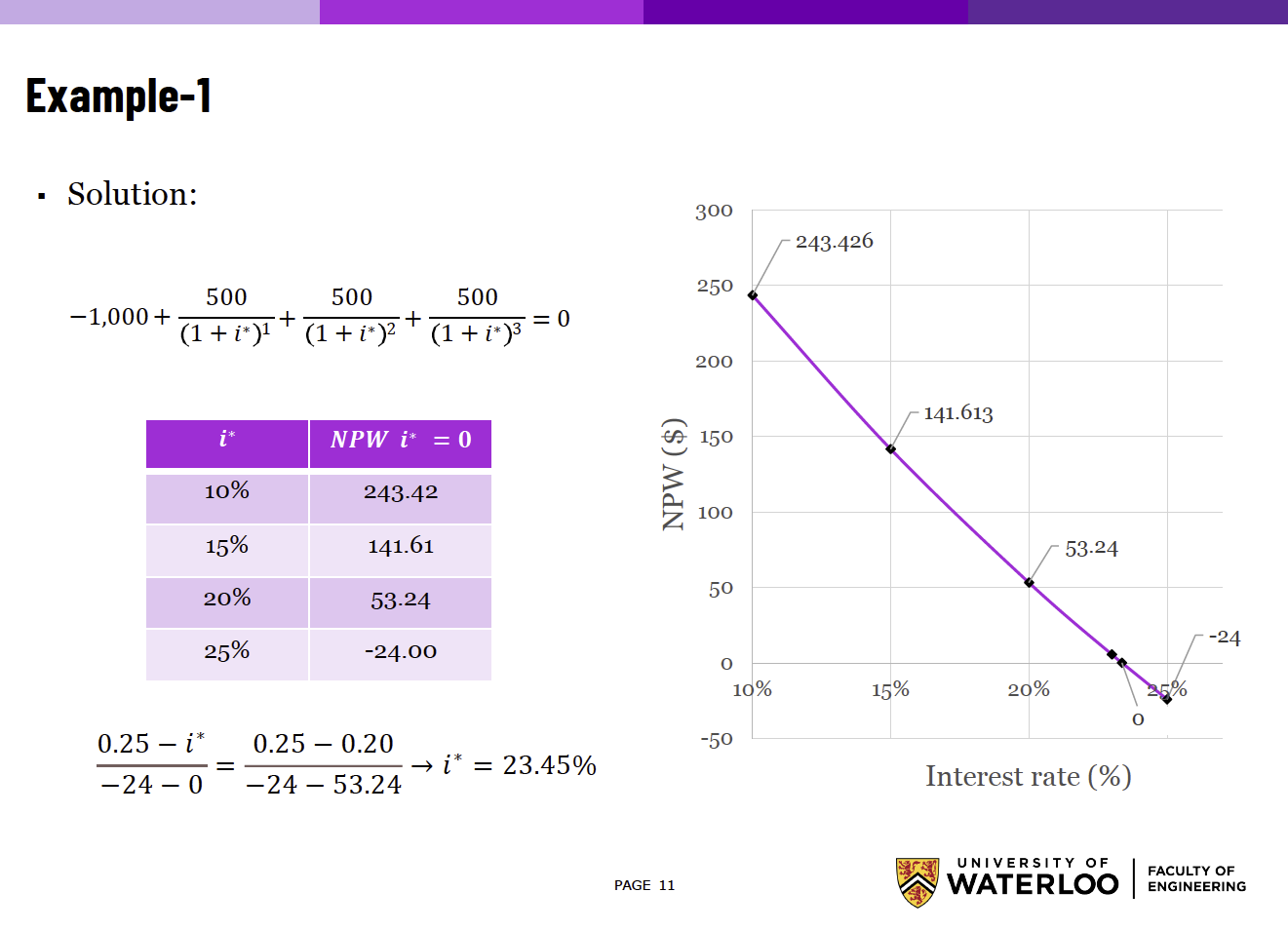

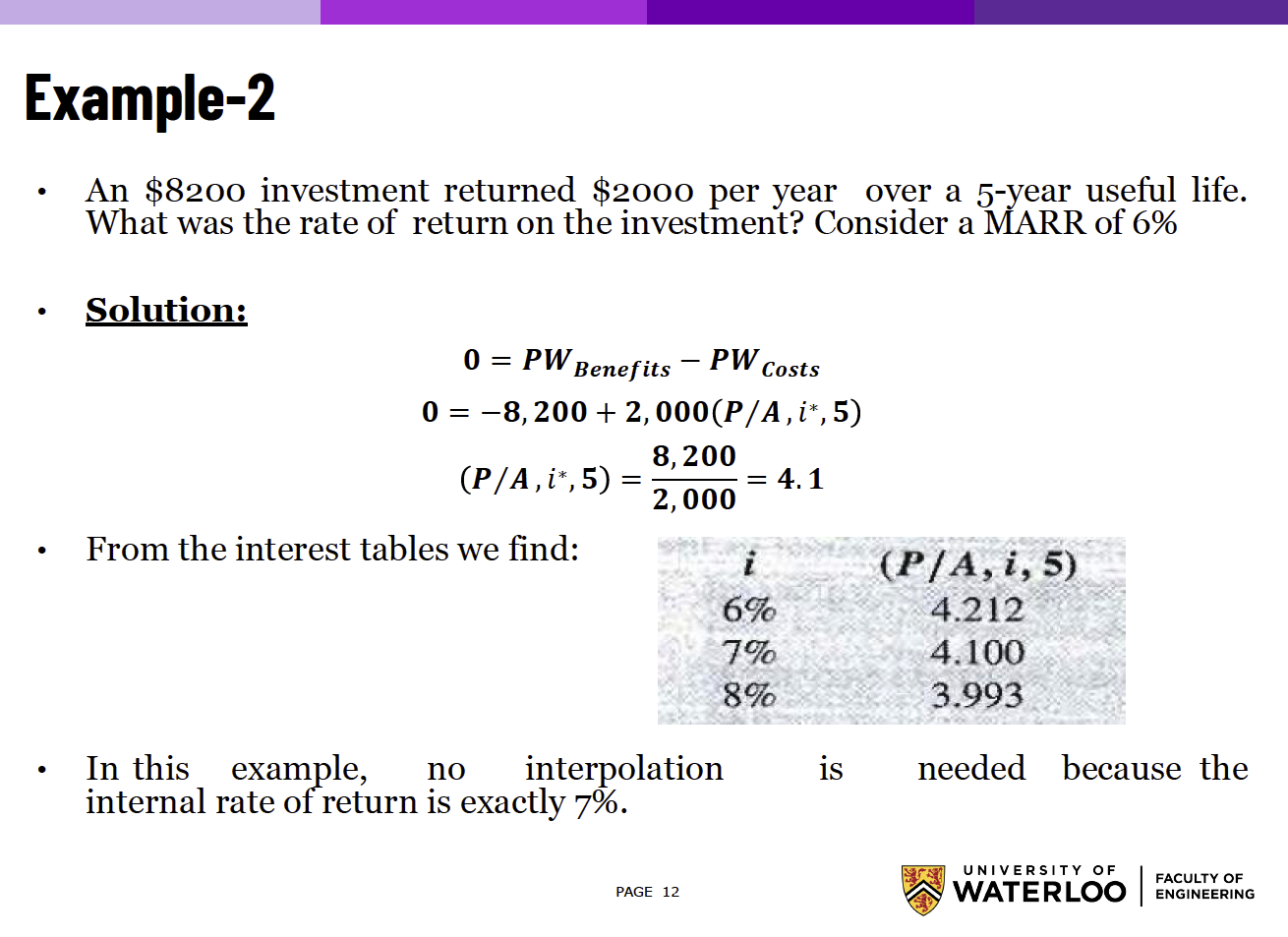

Rate of Return (ROR) Analysis

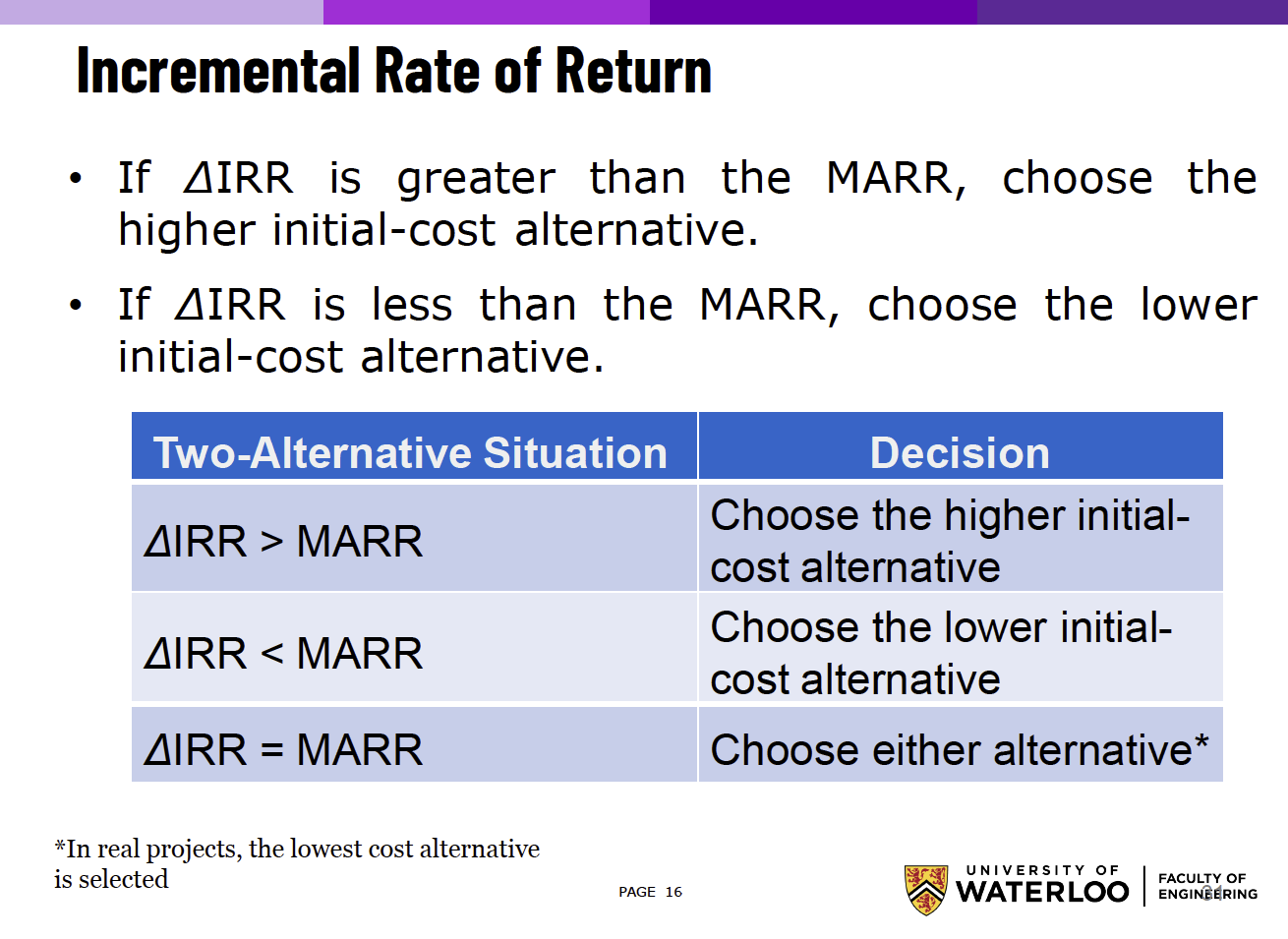

Incremental Rate of Return